VTS Office Demand Index: February 2021 Market Trends Report

Get the earliest available indicator of upcoming office leases and tenant sentiment, nationally and locally, in the VTS Office Demand Index (VODI) – a free, monthly resource from VTS.

The VODI represents 99% of new demand for office space in 7 markets – New York City, Washington D.C., Los Angeles, Chicago, Boston, Seattle, and San Francisco – and indicates behavior more than one year in advance of a lease hitting the market, and ahead of official employment figures.

Download the February 2021 VTS Office Demand Index Report

Key Takeaways

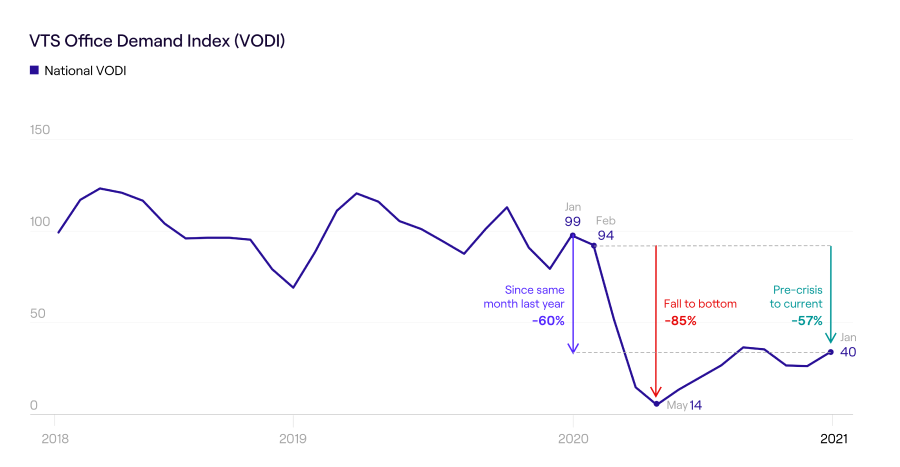

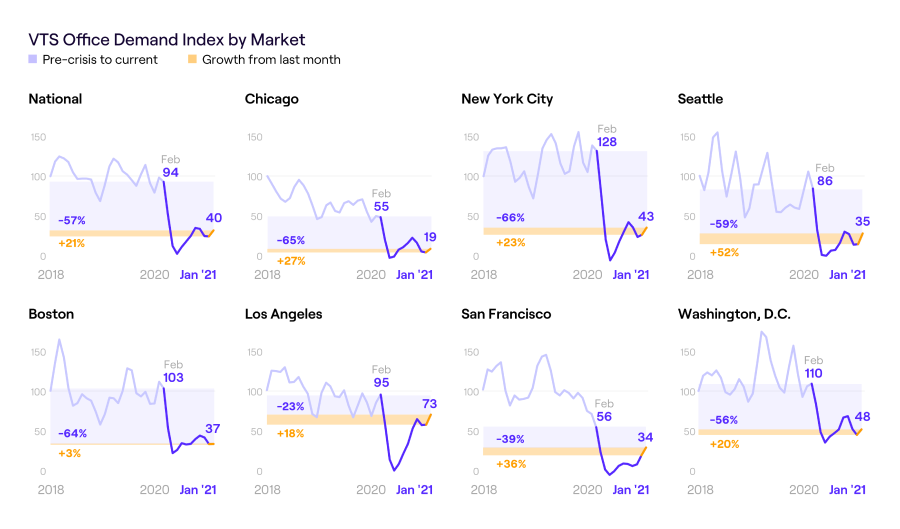

- Demand for office space fell by 85% in the three months following the start of the pandemic and has since regained 1/3 of the demand lost. As of January, the VODI is still down 57% from pre-pandemic levels.

- After experiencing the lowest bottom of all markets with almost no office tenant demand in 2020, San Francisco has experienced the strongest growth over the last quarter, recovering 58% of the demand lost in the early pandemic days.

- NYC office demand is still down 66% from pre-crisis levels, but 4 out of every 5 tenants in the market toured Trophy or Class A office space in January.

- Office demand in Boston and Chicago continues to struggle, only gaining 1 and 4 index points, respectively, over January.

ON-DEMAND WEBINAR

COVID-19 in 2021: Priorities & Predictions for CRE Execs

What are CRE executives doing this year to prepare for demand recovery post-pandemic? Stream this convo with Brian Kingston, Chief Executive, Brookfield Property Group and VTS CEO Nick Romito to learn how leaders are using data to come out this crisis on top.