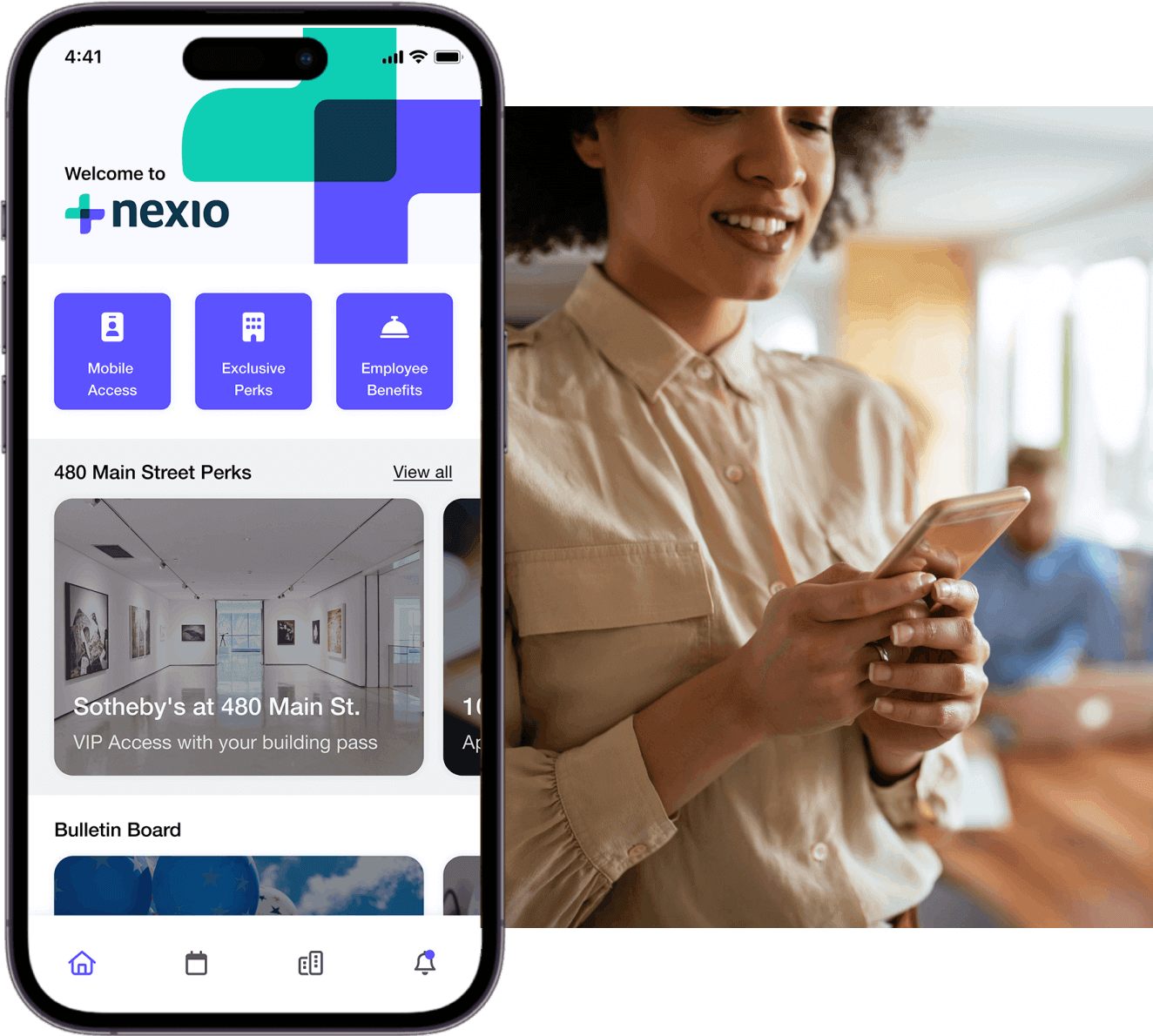

About VTS Activate

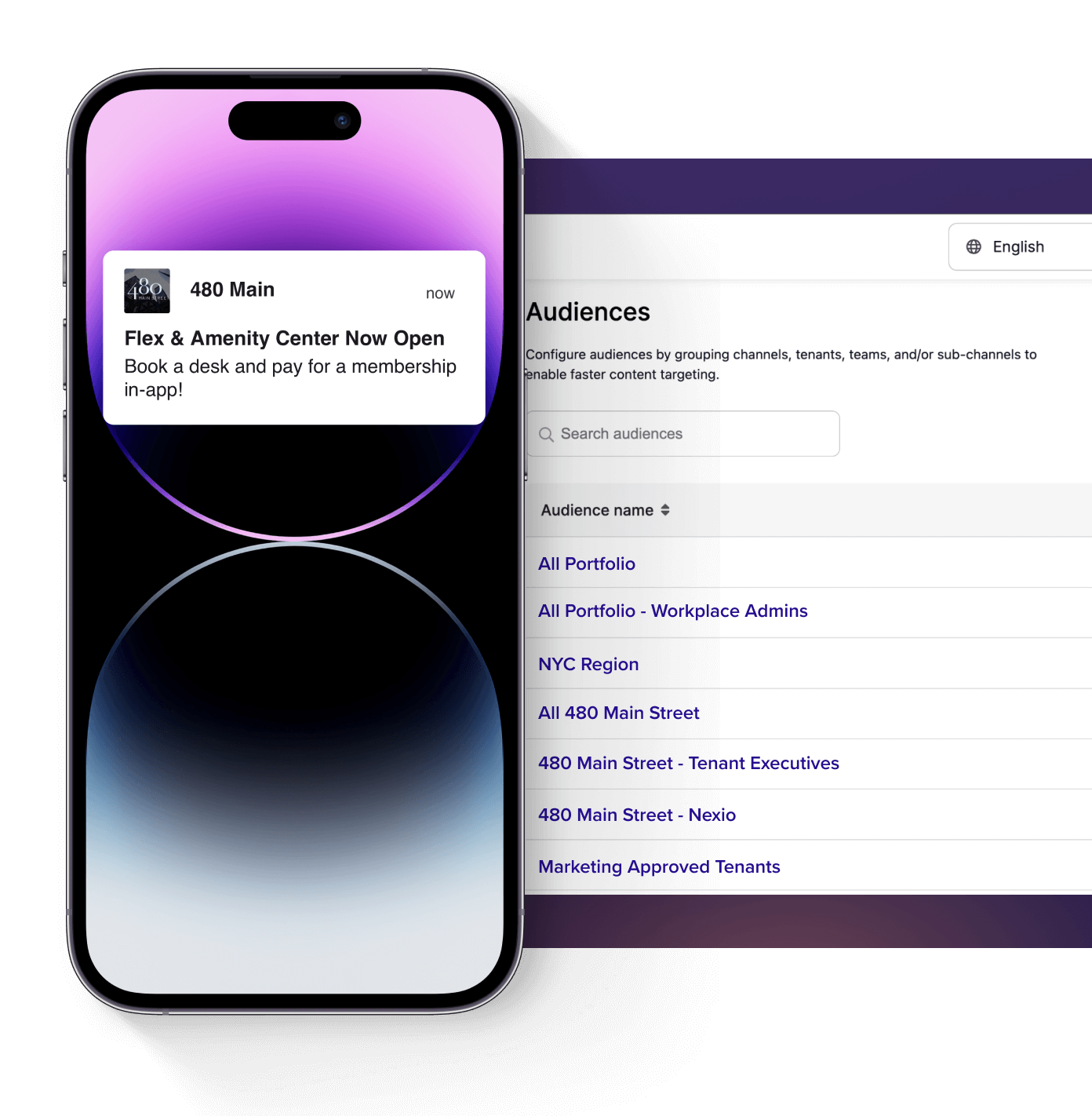

VTS Activate is now the world’s largest tenant experience solution. Leading commercial real estate owners and operators trust VTS Activate to power their building experience, from access, to operations, engagement, and insights. VTS Activate is the only tenant and resident experience platform to deliver a personal, branded experience in a building, in a suite or unit, and across buildings–all through one app.

Learn More