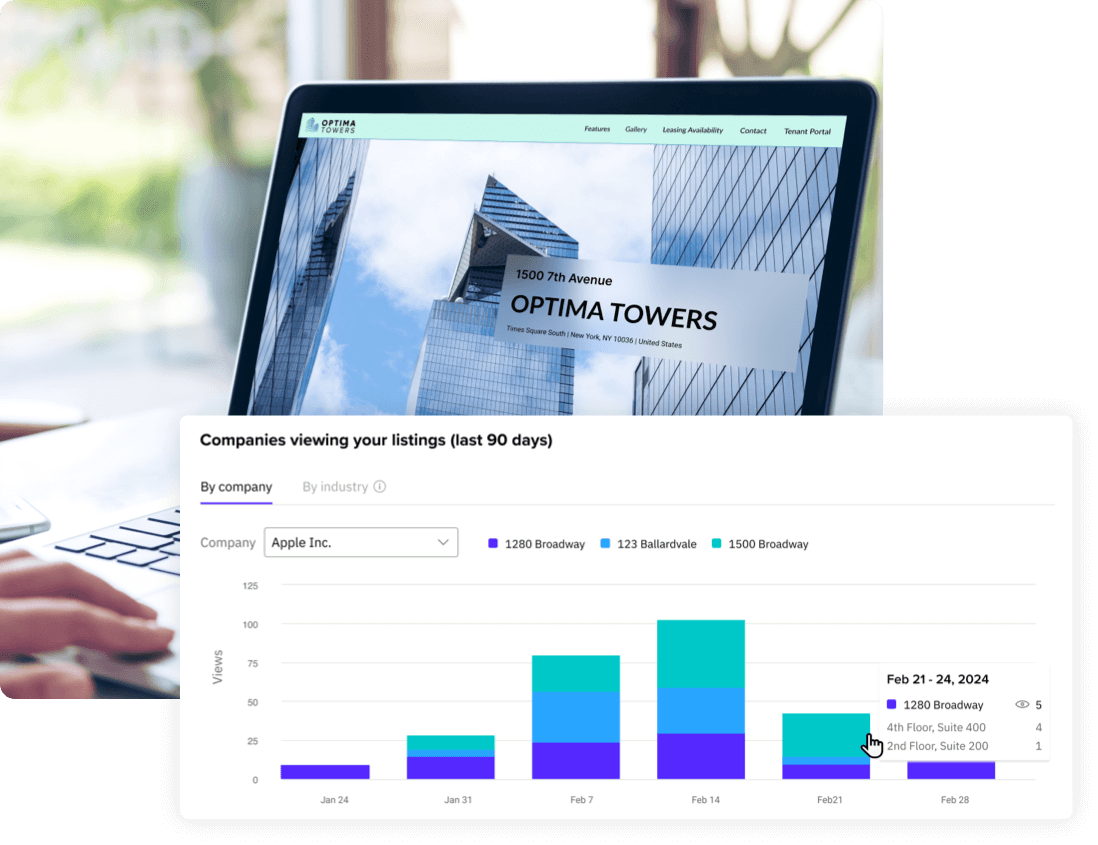

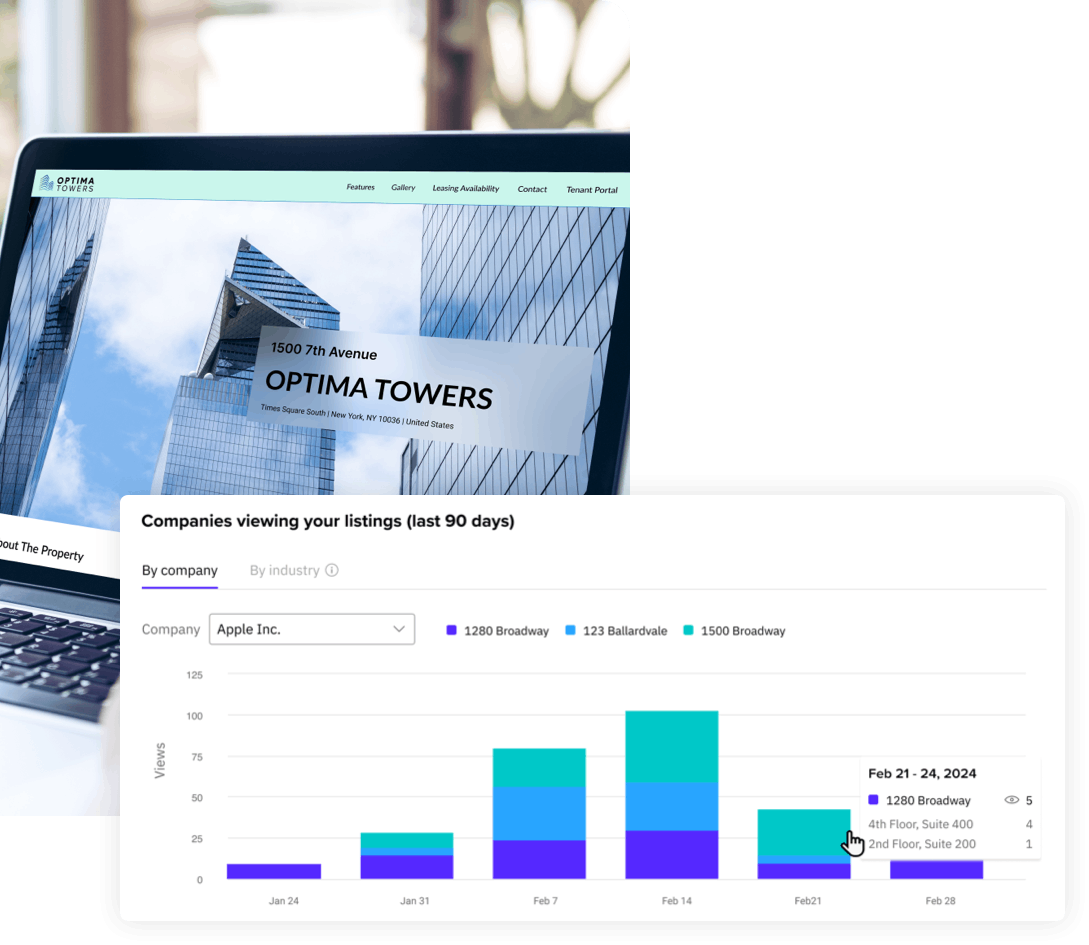

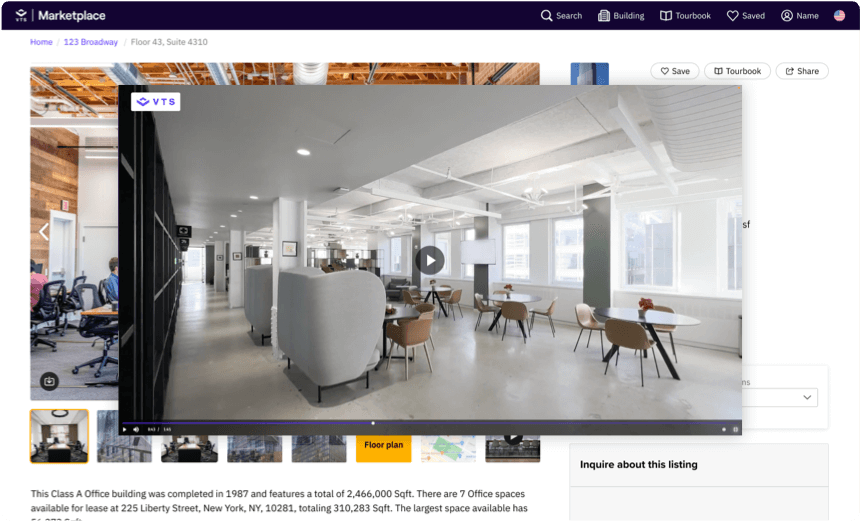

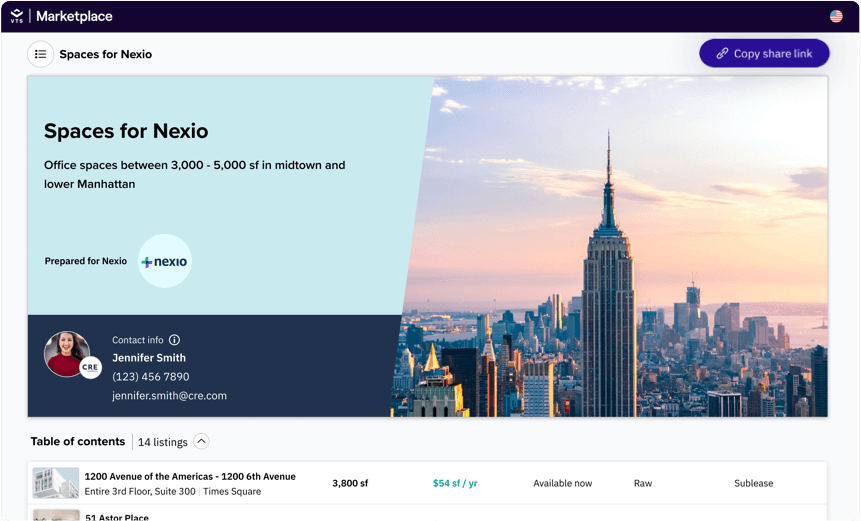

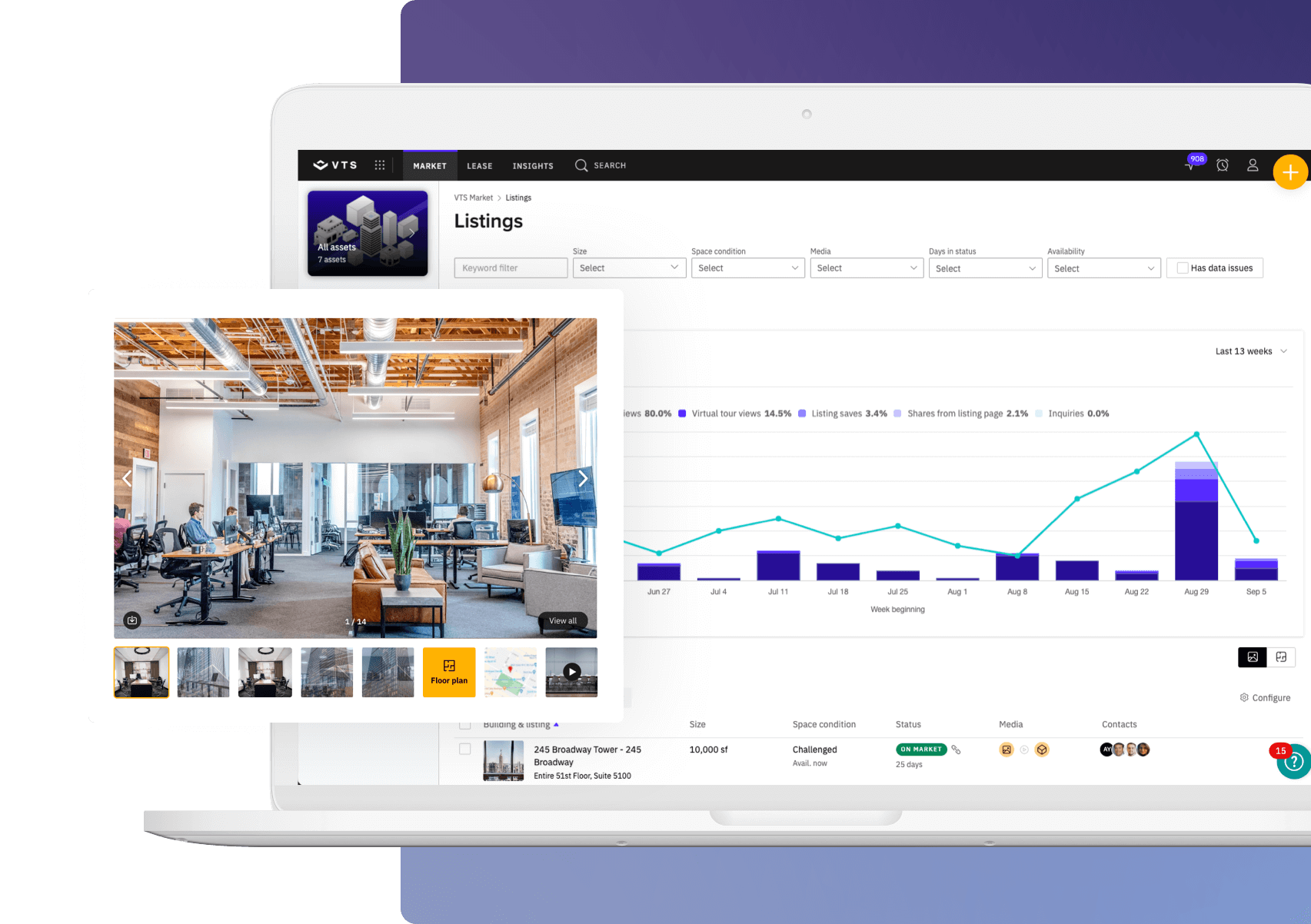

VTS Market simplifies content management for online listings, allowing CRE leasing and marketing professionals to easily upload, update, and manage their digital content. Users can request listings to be created on their behalf, complete with high-quality images, detailed descriptions, and immersive virtual tours. Once listings are created, VTS Market users can make their own quick adjustments to listing details, ensuring that all information presented accurately reflects the property’s offerings. Best of all, VTS Market listings are connected to an owner’s lease roll in VTS Lease – which means that listing availability is automatically updated as spaces are taken on or off-market.