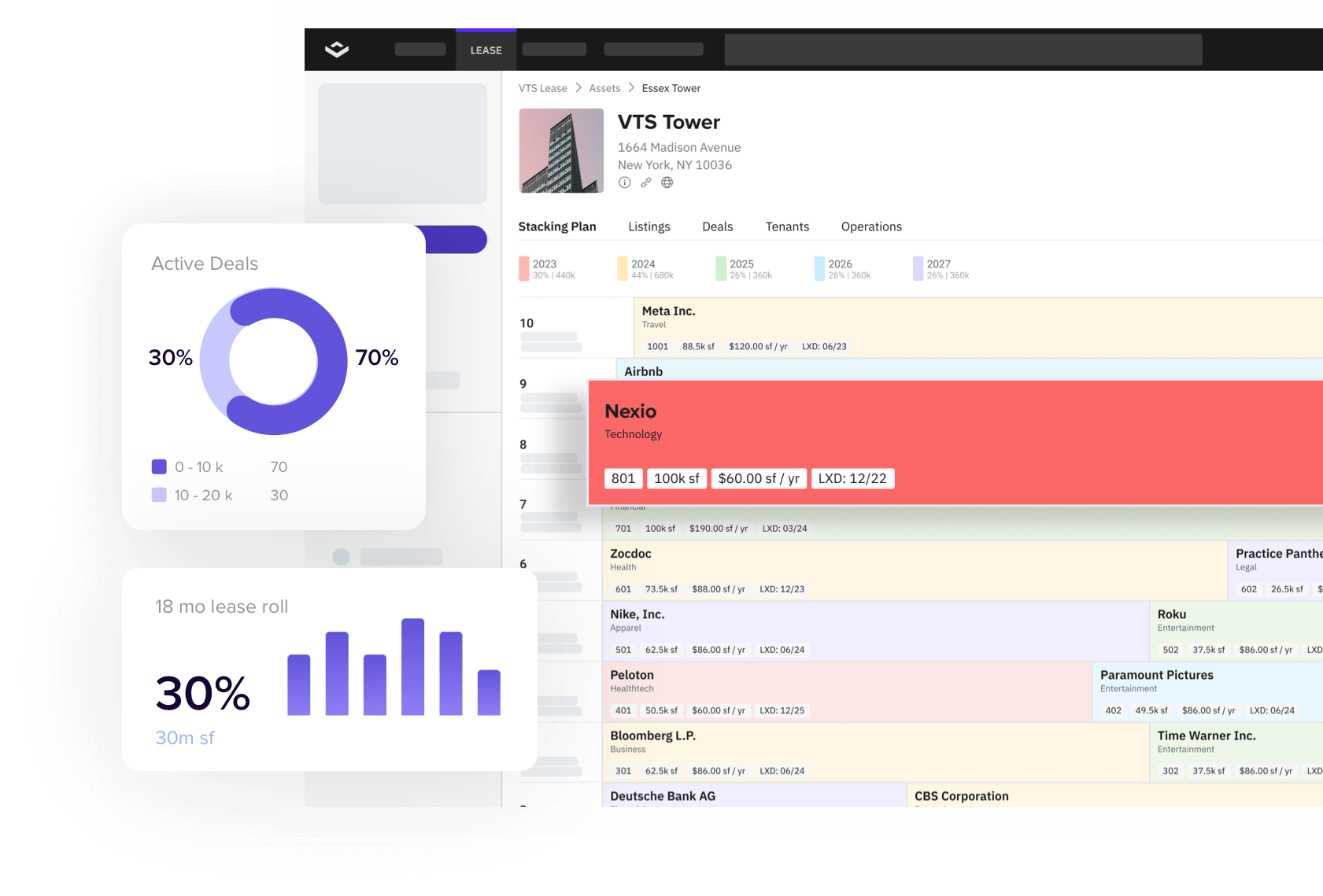

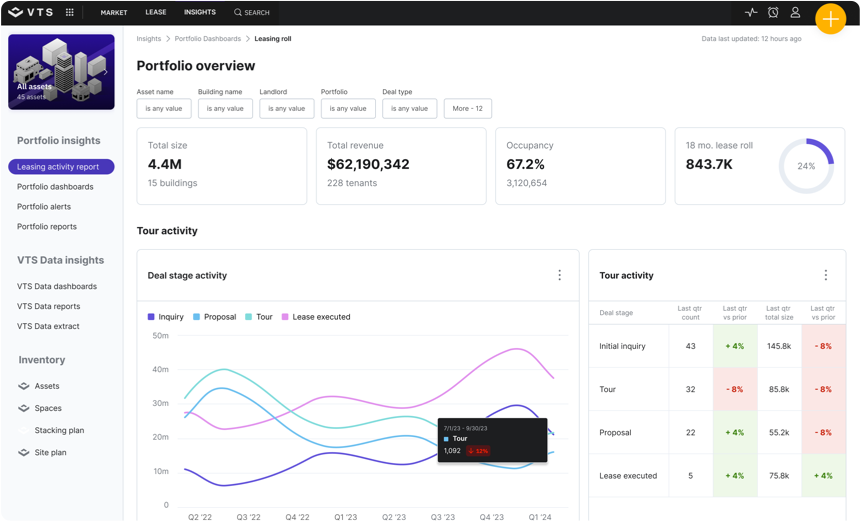

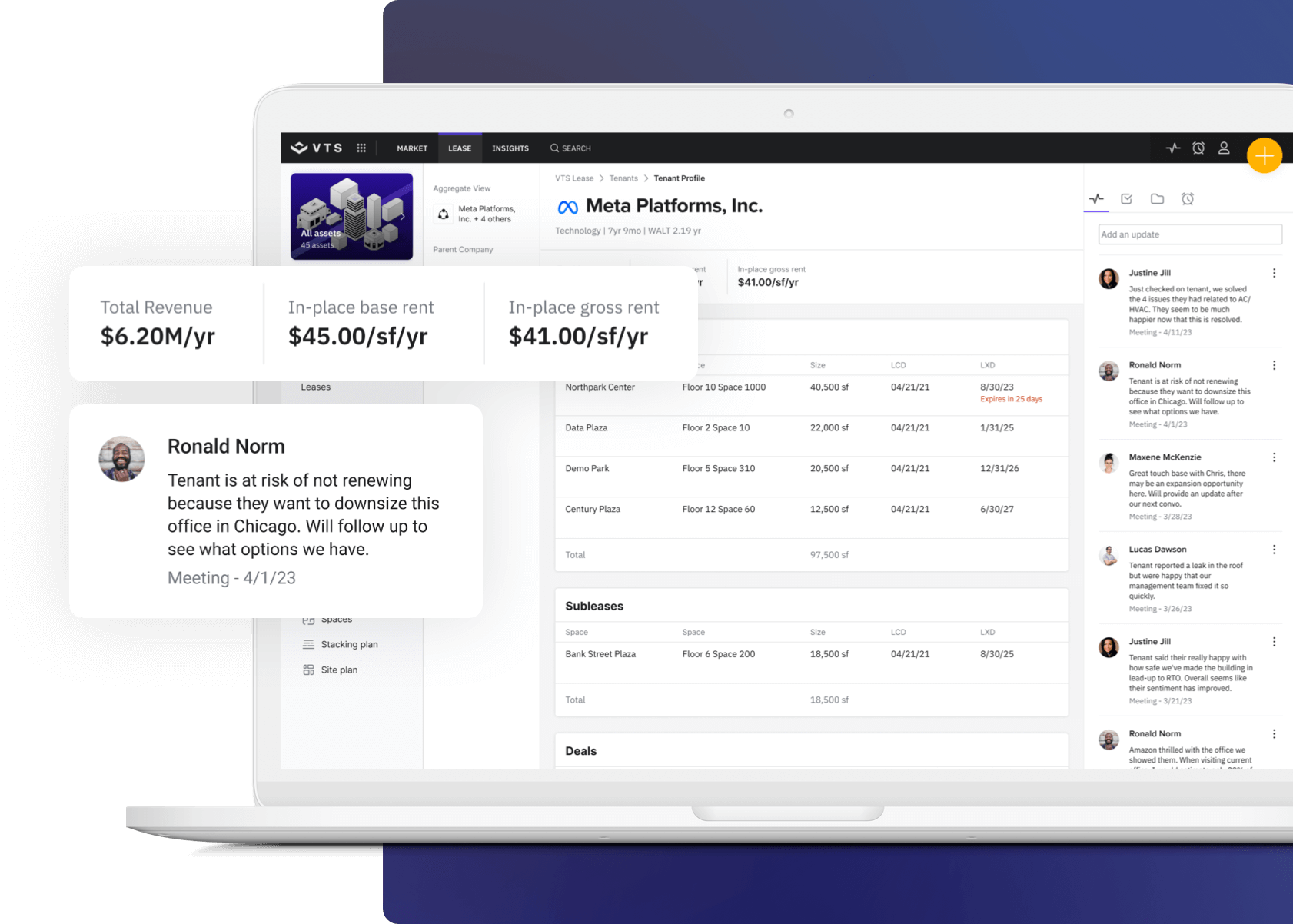

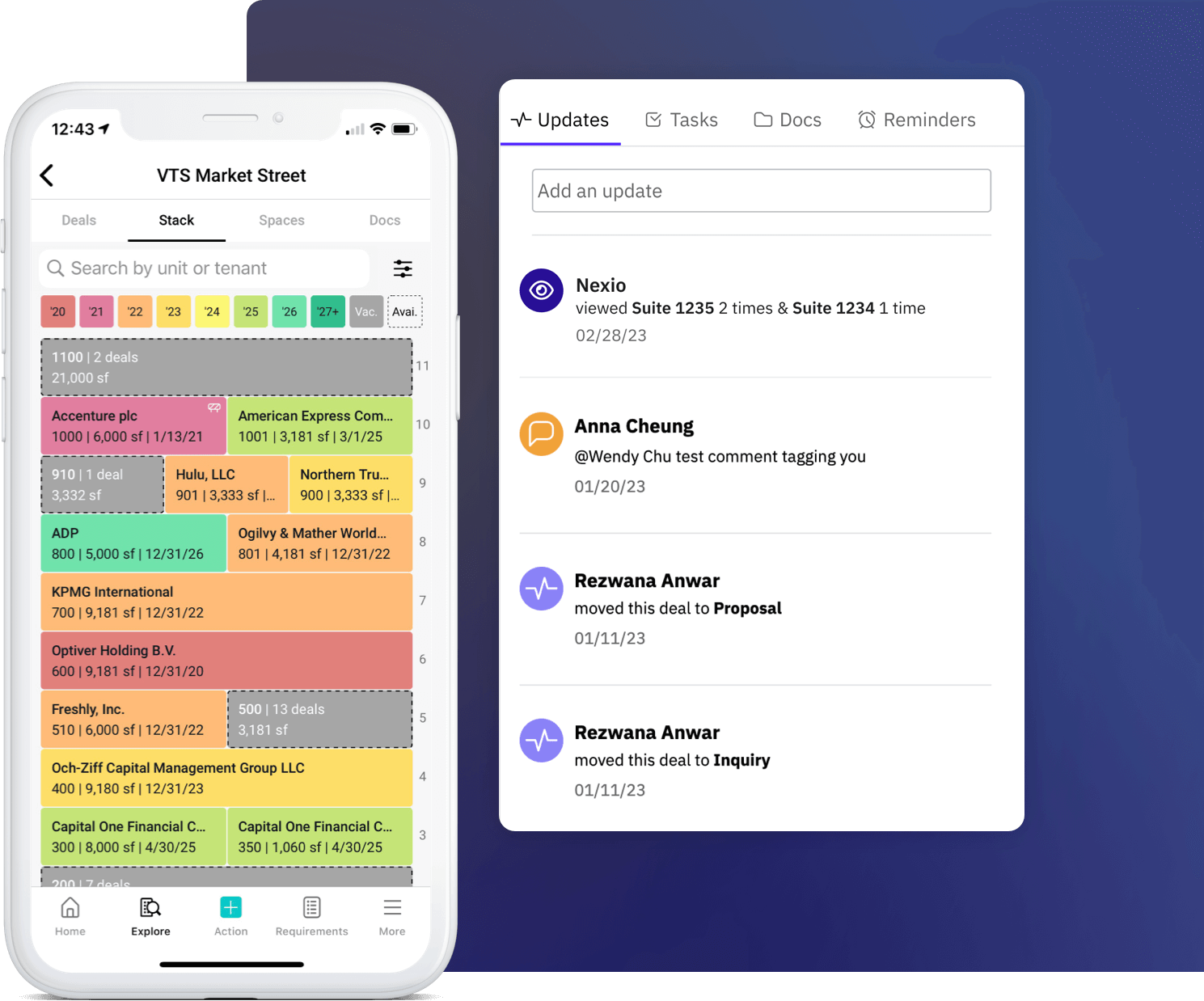

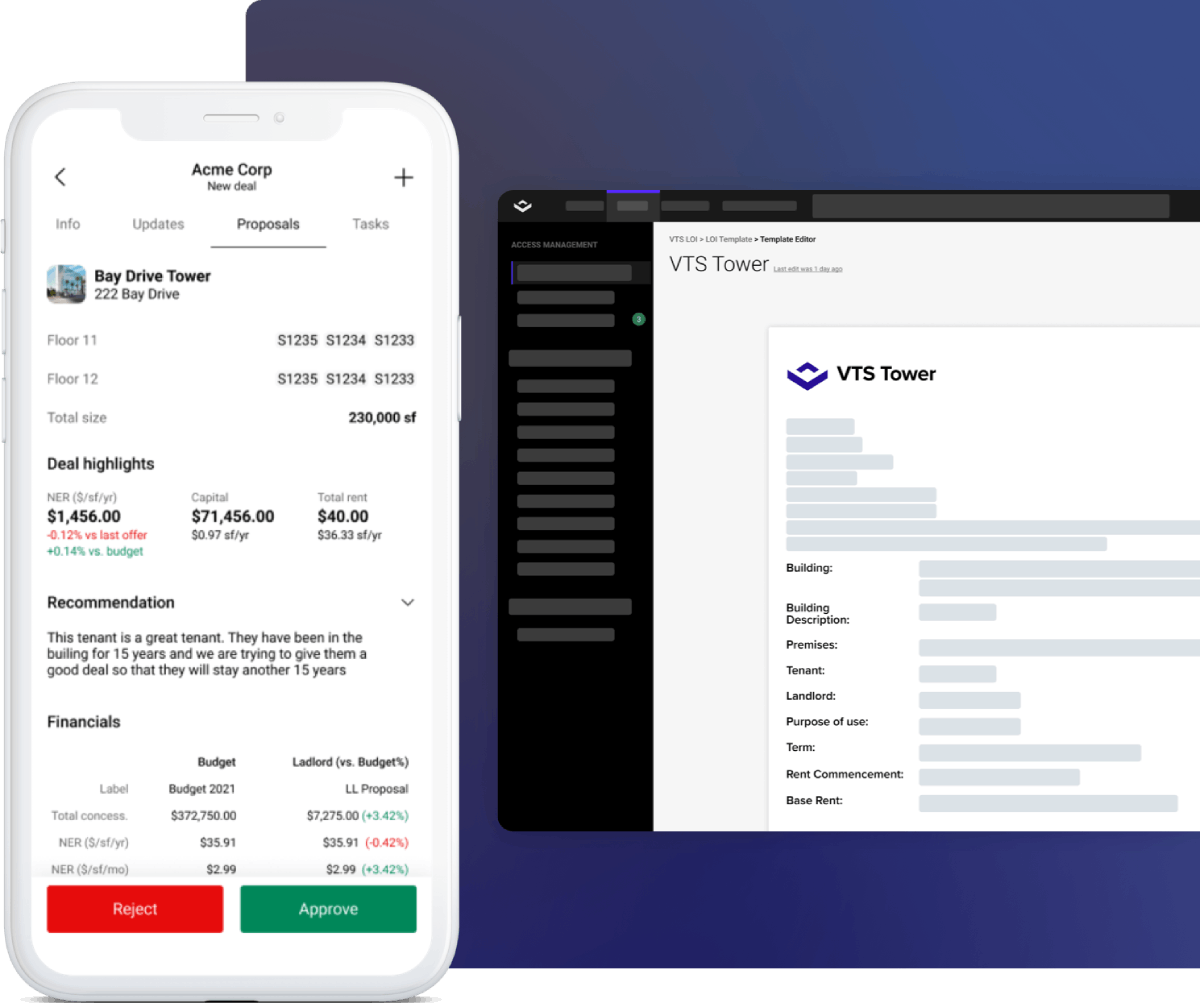

Your system of action, your source of truth

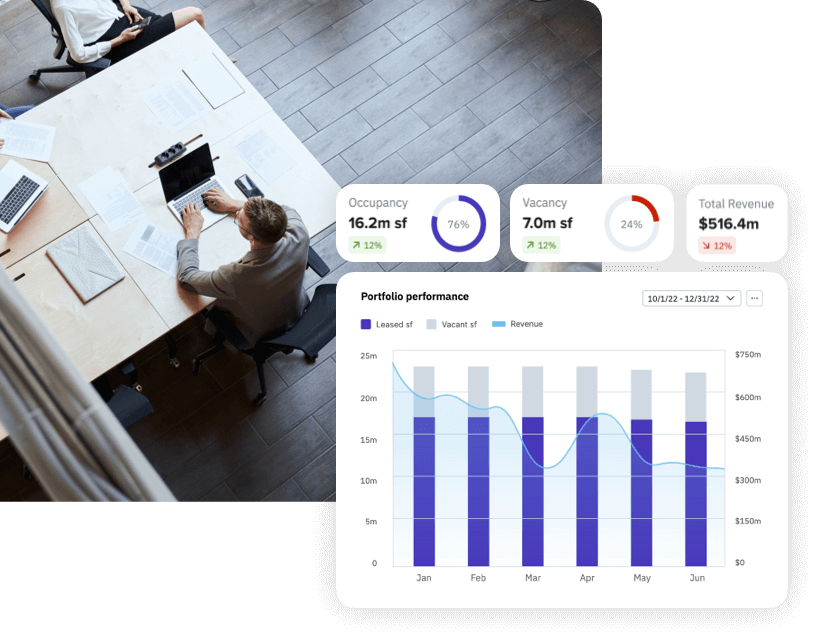

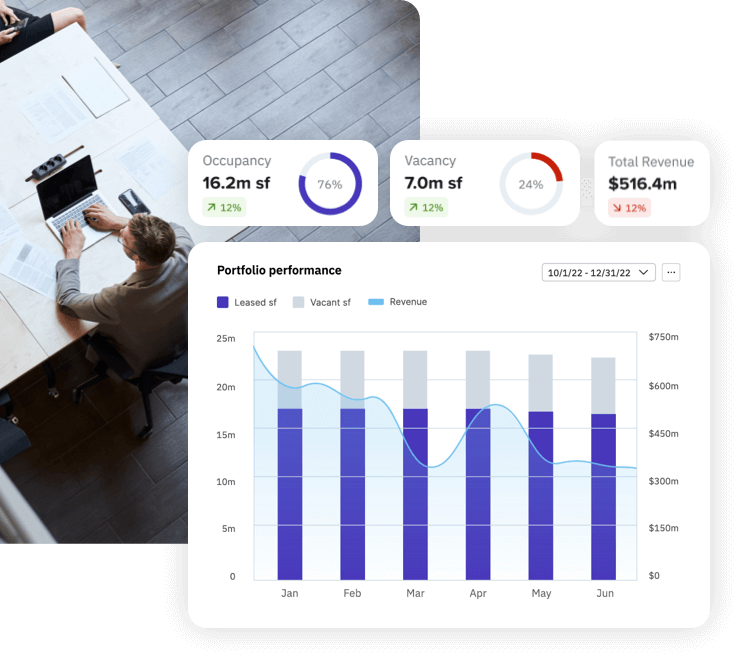

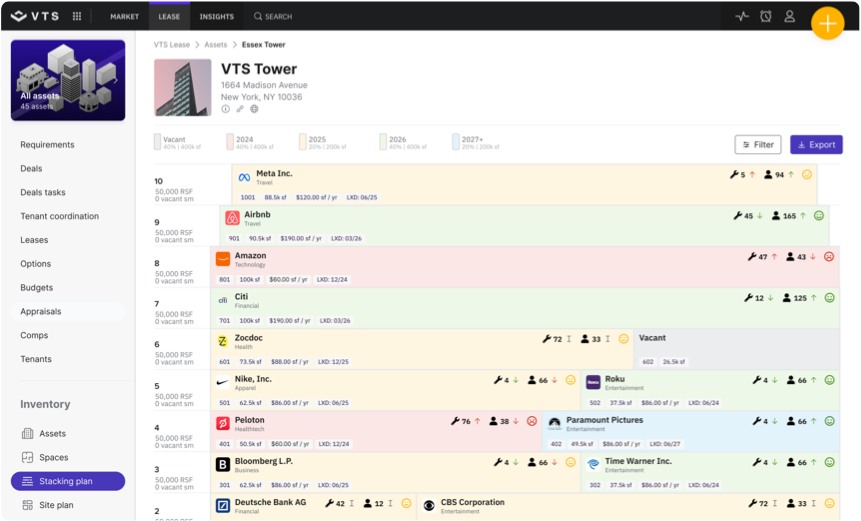

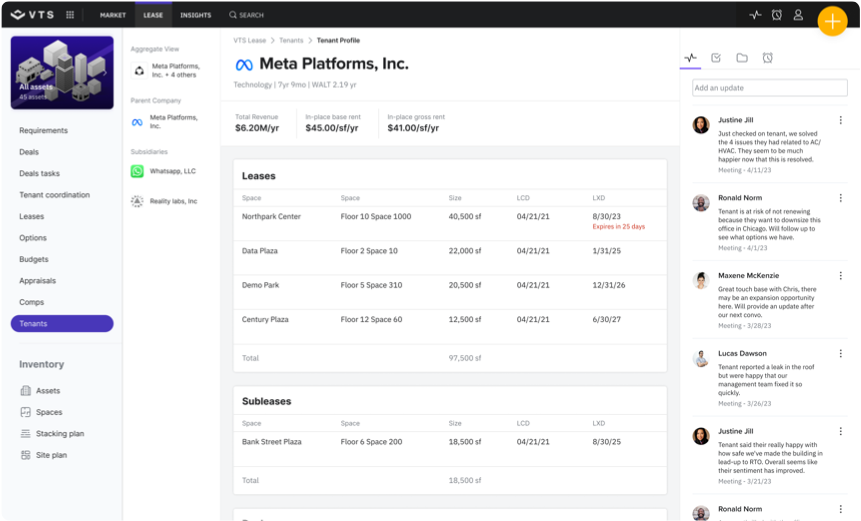

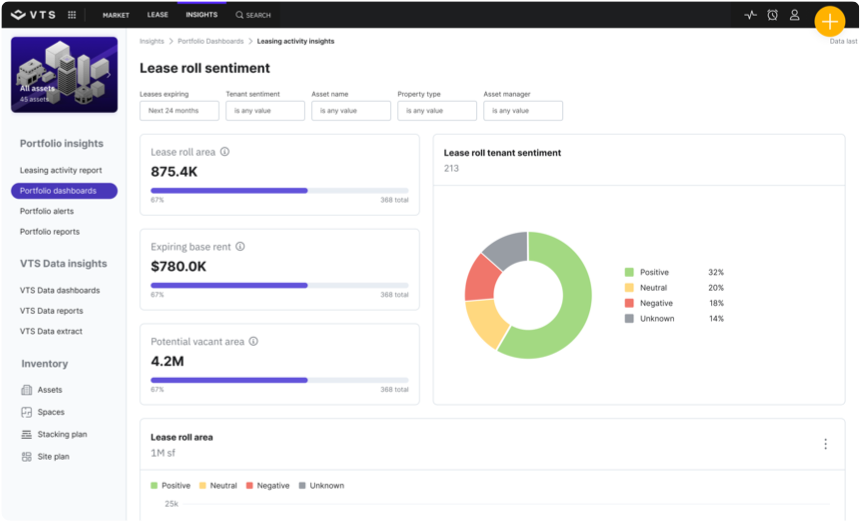

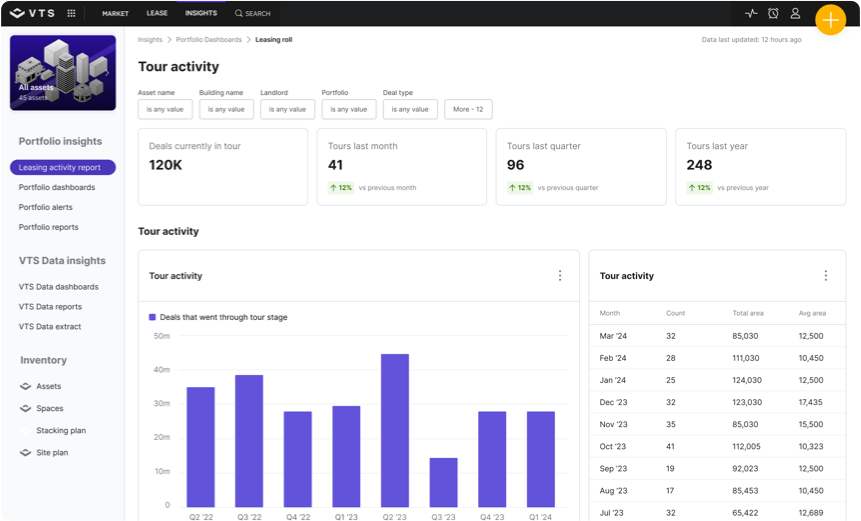

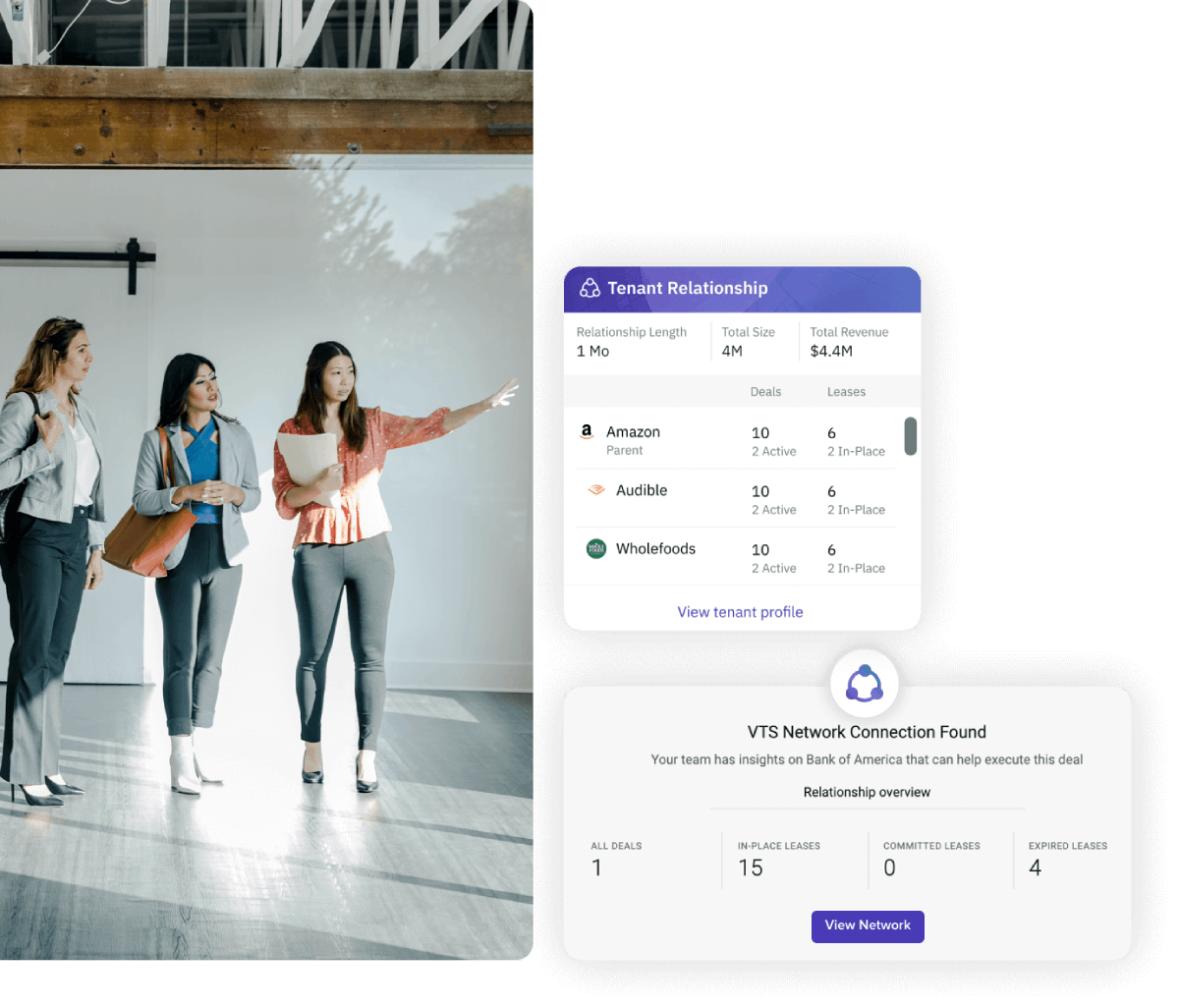

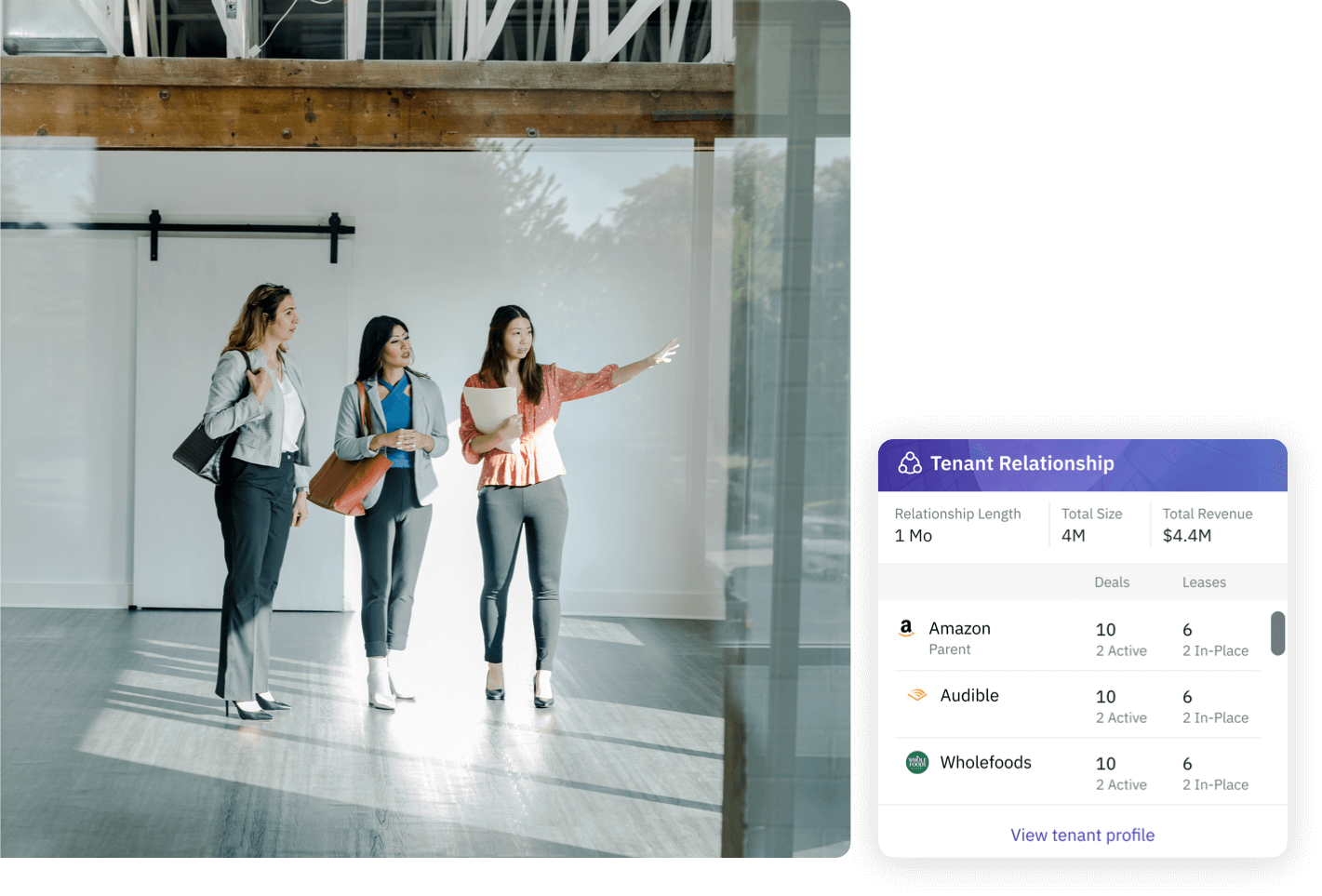

Increase the value of your portfolio with VTS Lease. Efficiently move deals through the lead to lease process, leverage your tenant relationships to inform your leasing strategy, and gain an unparalleled view into portfolio performance to boost revenue.