The next generation of VTS is here

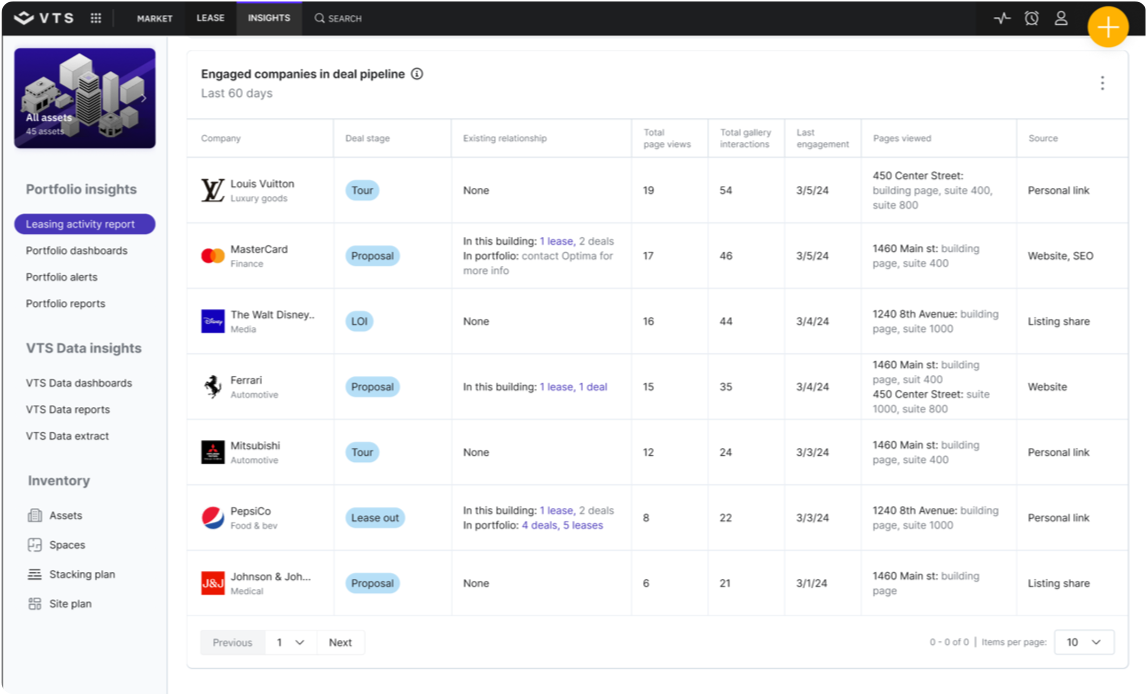

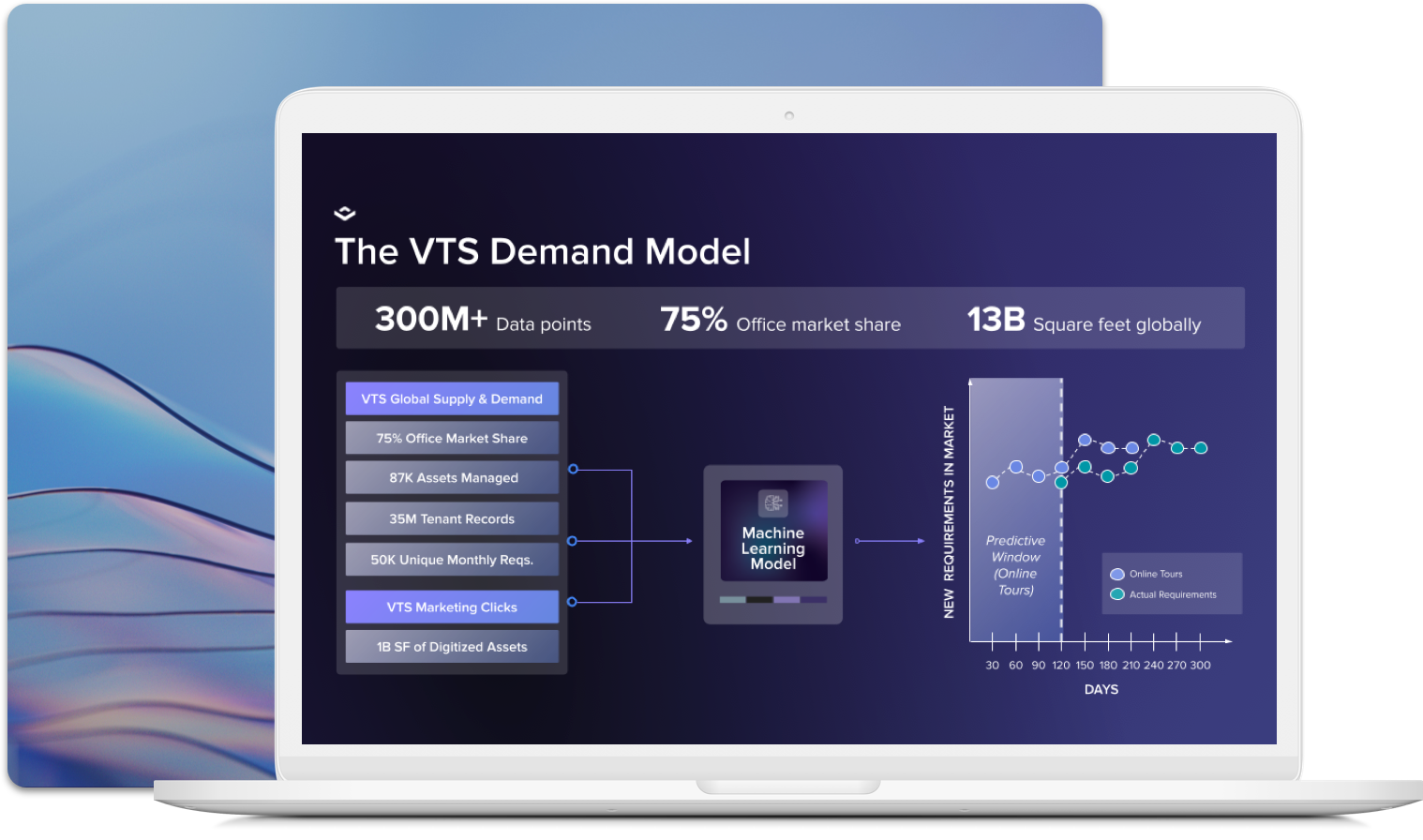

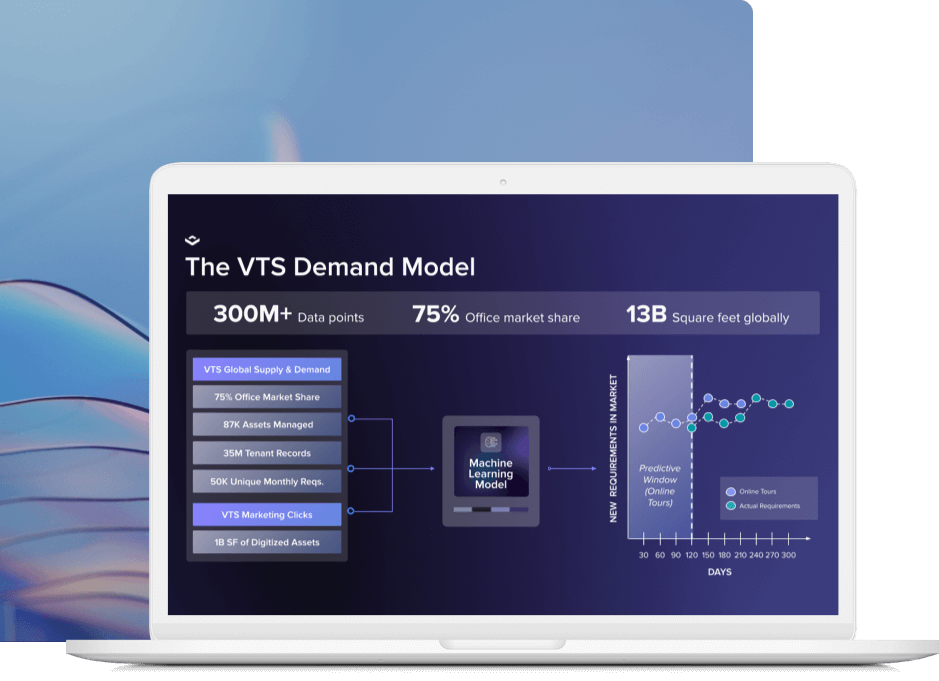

Powered by over 300M data points across 13B sq ft of assets managed exclusively on the platform, VTS 4 allows you to accurately predict and pursue tenant demand.

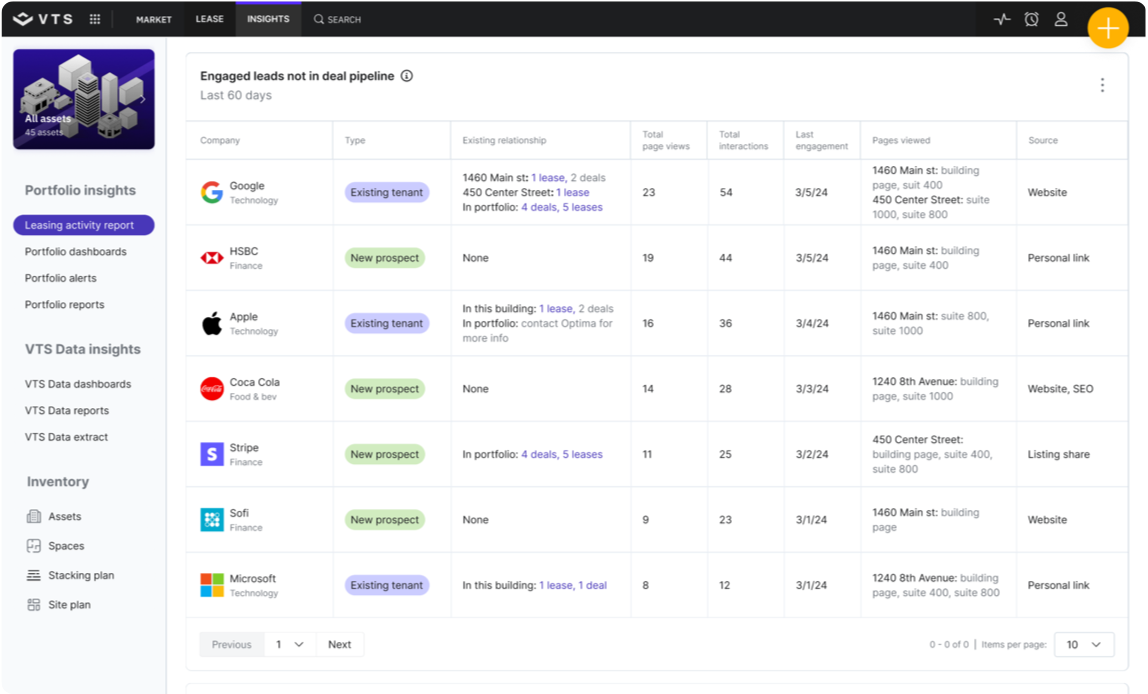

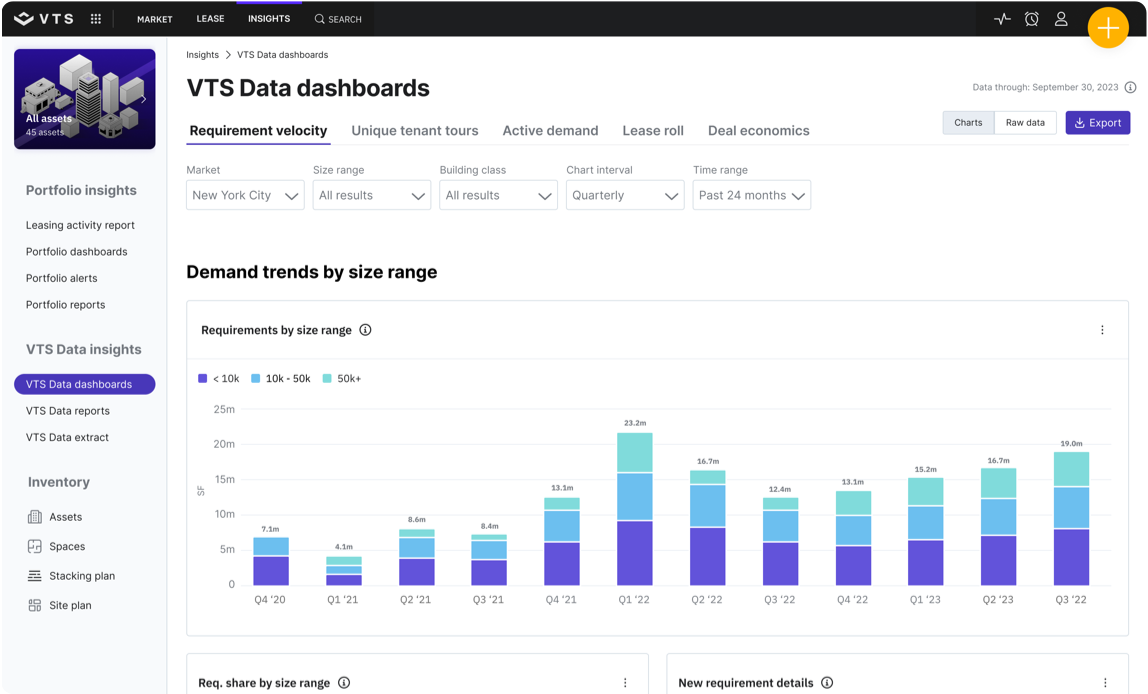

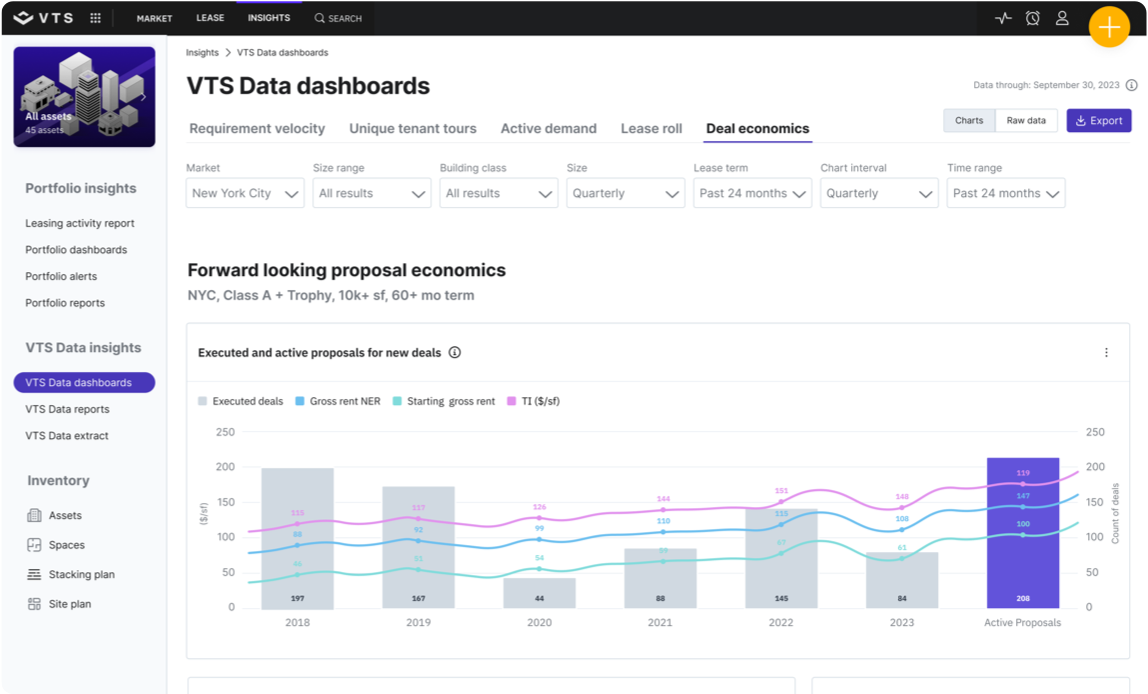

Uncover interested tenants before they begin touring so you can prospect aggressively from the start, and position your assets to meet demand by understanding what will drive leasing activity 6-9 months ahead of net absorption.