The Multi-Product Platform Solution for CRE

Based on your selection

Bring your portfolio management, leasing, marketing and building operations into the VTS Platform to transform how your organization makes business and investment decisions.

Bring your leasing operations into the VTS Platform to transform how your organization makes decisions and executes lease-up strategy.

Bring your marketing operations and leasing into the VTS Platform to transform how your organization makes decisions and executes go-to-market strategy.

Bring your leasing and building operations into the VTS Platform to transform how your organization makes decisions and executes tenant engagement strategy.

Bring your portfolio management operations and leasing into the VTS Platform to transform how your organization makes decisions and executes positioning strategy.

Bring your building operations, leasing and marketing into the VTS Platform to transform how your organization makes decisions and executes tenant experience strategy.

Bring your portfolio management, leasing and building operations into the VTS Platform to transform how your organization makes decisions and executes investment strategy.

Bring your building operations into the VTS Platform to transform how your organization makes decisions and executes asset strategy.

Bring your portfolio management, leasing and marketing operations into the VTS Platform to transform how your organization makes decisions on capturing demand.

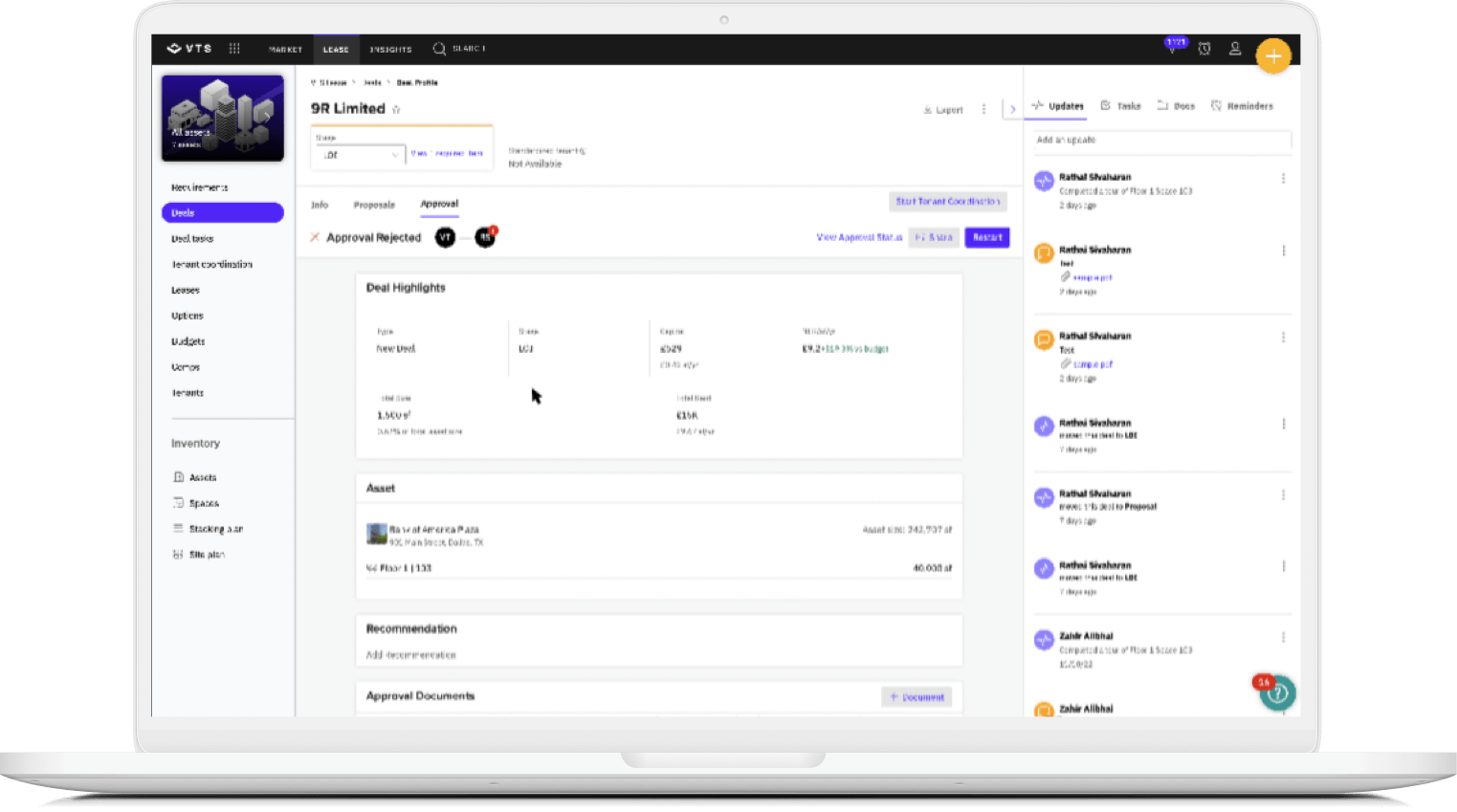

VTS Lease

Bring all of your deals, leases, & tenants online.

With VTS Lease, increase the value of your portfolio by more proactively filling leases, achieving the best deal terms, and building sustainable relationships with tenants.

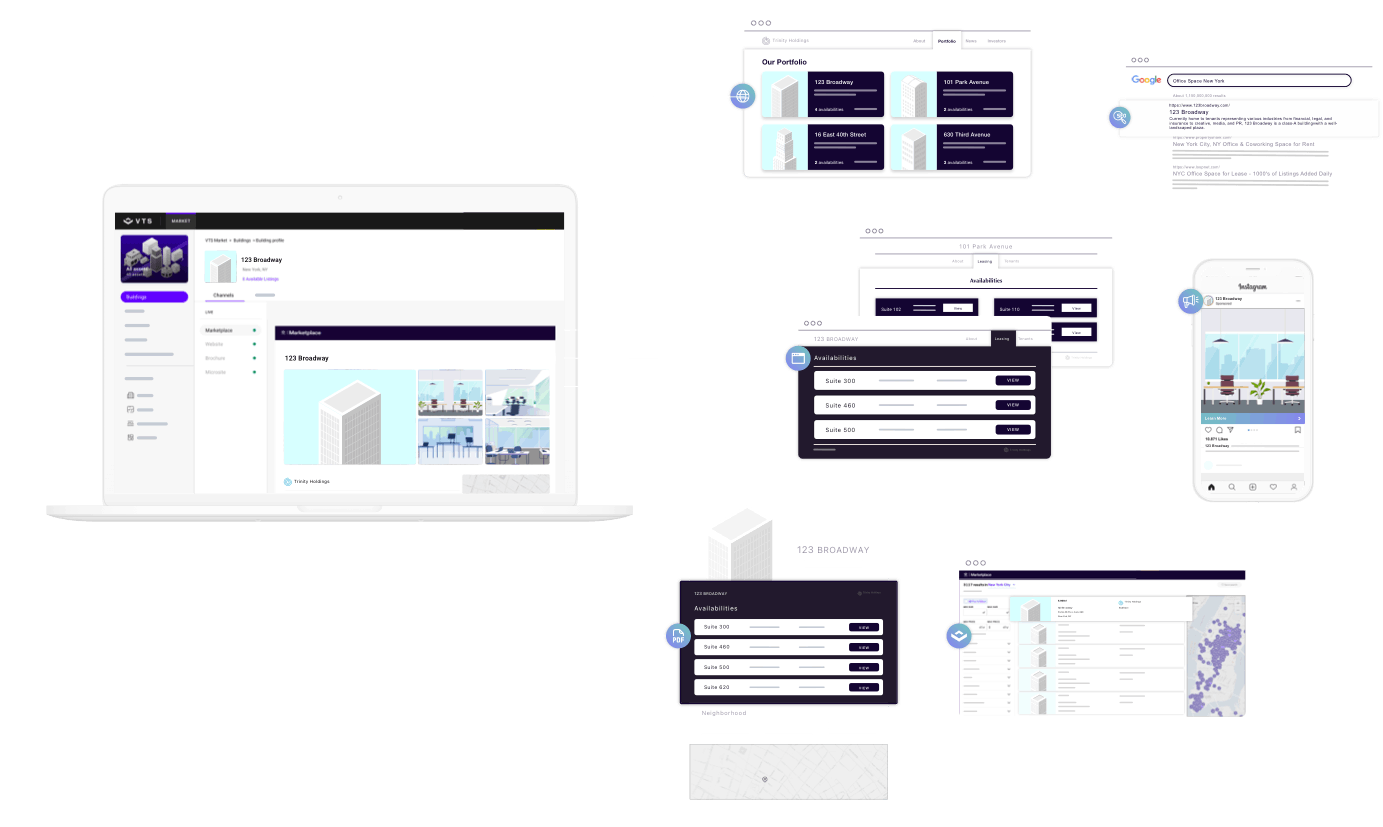

Learn MoreVTS Market

Get more deals done, faster.

Marketing and leasing teams can collaborate like never before to bring available spaces to market and drive deal opportunities forward with tenants.

Learn MoreVTS Activate

Activate every tenant, space, and team

Turn your portfolio into a network of workspaces, driving value for tenants and insights to better serve them.

Learn MoreVTS Data

Get a pulse on what’s happening in the market today.

Kick outdated and inaccurate data to the curb and make more informed decisions by tapping into the only real-time demand data source available today.

Learn More

VTS is more than just technology, software, and insights — it's a dedicated team of experts inside VTS who know the ins and outs of CRE.

-

66%

of technology rollouts fail due to a lack of change management, adoption, and alignment around business goals and metrics.

-

-

-

-

-

WE ARE YOUR PARTNER

Give us your challenges, and we’ll work with you on a solution.

Talk to a member of our team today to discover what the VTS Platform can do for your business.

Talk to our Team