There are early signs of mean reversion in average tenant size. After bottoming at 11.1k sf in November 2022 (a 23% drop compared to pre-COVID levels), average tenant size has increased 7% to 12.0k sf as of May 2024.

This recovery is fueled by a collision of two major forces: a persistent "return to office" push by major employers and a softening labor market.

The Impact of a Softening Labor Market

The push for physical office attendance has gained traction as employer leverage increases. This shift is closely tied to current economic conditions:

- Interest Rates: Currently at 5.5% (as of August 2023), the highest level in 22 years.

- Job Postings: According to Indeed, national postings are 32% below the post-COVID highs of December 2021.

- Unemployment: The June 2024 rate hit 4.1%, 60 basis points above the cycle low. Long-term unemployment (27+ weeks) has surged 36% YoY.

Shifting Work Patterns & Demand

As the labor market weakens, firms are successfully enforcing "office first" policies. This is reflected in the declining prevalence of flexible work:

- Remote/Hybrid Mentions: Postings mentioning these terms fell 24% from their peak (7.9% today vs. 10.4% in 2022).

- Tech Sector Shift: Remote/hybrid postings for software jobs are down 21%.

- Physical Attendance: Placer.ai data shows physical occupancy is up 18 percentage points, reaching 68% of pre-COVID levels.

- National Demand: VTS data shows office demand is up 23% compared to February 2022.

"Size-Adjusting" the Opportunity: 14 Markets Analyzed

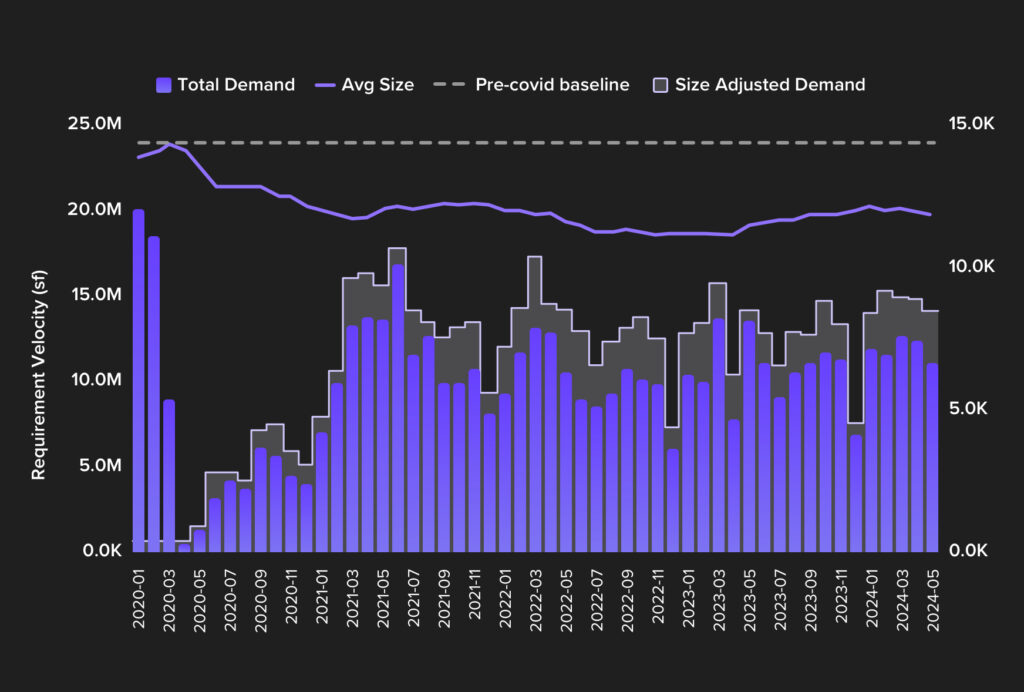

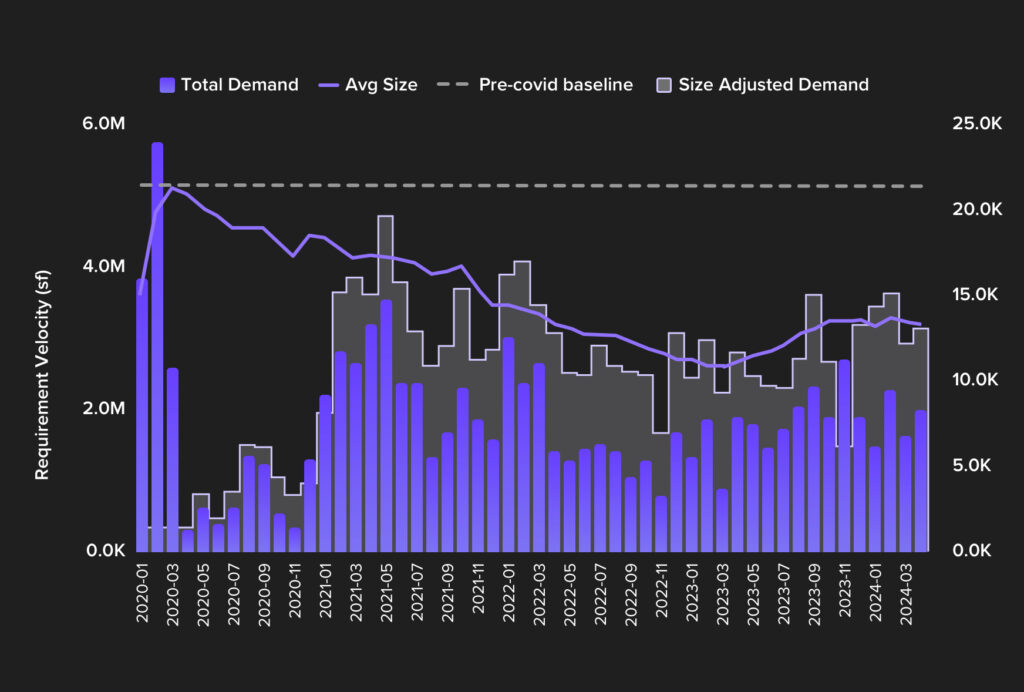

VTS analyzed 13 U.S. markets and London to determine the benefit of mean reversion. By "size adjusting" new demand to pre-COVID averages, the analysis reveals significant hidden opportunities.

Key Findings:

- Potential Demand Growth: If sizes revert fully, demand would be 19% higher than current TTM (Trailing 12 Month) levels.

- Tech Hubs Lead the Way: Tech-heavy markets stand to gain the most, with an estimated +59% increase in demand on a size-adjusted basis.

- Top Beneficiaries: 1. Silicon Valley 2. Boston 3. Seattle 4. San Francisco

Investment Outlook

Several markets, including Silicon Valley, New York, San Francisco, and Los Angeles, already show a higher count of tenants entering the market than pre-COVID annual rates. However, because current deal sizes are smaller, the total square footage lags. As tenant sizes revert to historical norms, these markets represent compelling investment opportunities "hiding in plain sight."

Visit: Latest VTS Data Shows the Impact of Tariffs Extends Beyond Global Trade

What’s Next?

In Part 2 of this series, we will dive deeper into market-by-market trends with a specific focus on the tech sector. We will also introduce data for two newly launched VTS markets: Austin and Atlanta.

For additional access to the data used in this analysis, contact dataquestions@vts.com.

Chart 1: National demand + size adjusted demand, all industries.

Chart 2: National demand + size adjusted demand, tech only.

FAQs: The Reversion of Office Tenant Size

1. What does "mean reversion" mean in the context of office tenant size?

Mean reversion is the theory that data points that have deviated significantly from their historical average will eventually return to that "mean" or average level. In this context, it refers to the trend of average office tenant sizes—which shrunk by 23% during the height of the pandemic—gradually growing larger again as companies move away from extreme hybrid/remote models and return to more traditional office-first strategies.

2. Why is a "weaker labor market" helping to drive people back to the office?

In a strong labor market, employees have more leverage to demand fully remote or highly flexible work. As the labor market softens (evidenced by the unemployment rate rising to 4.1% and a 32% drop in national job postings), employers gain more "bargaining power." This leverage allows firms to implement and enforce stricter "office first" policies, which in turn leads to a need for larger physical footprints and increased square footage per tenant.

3. Which specific markets are positioned for the strongest recovery?

The markets with the highest "upside" are those that saw the most dramatic contraction in tenant size due to their high concentration of tech companies. Silicon Valley, Boston, Seattle, and San Francisco stand to benefit the most. If these markets revert to their pre-COVID average tenant sizes, the tech industry alone could see a demand increase of up to 59% compared to current levels.