We recently launched VTS AI, which, among many tech things, provides customers with the most advanced CRE data and insights available. The analysis below is an example of the enhanced level of market intelligence that VTS AI provides our customers, delivering the most comprehensive view of commercial real estate.

A VTS Data analysis of August 2025 commercial office space requirements reveals that San Francisco and New York are experiencing a significant increase in demand, outpacing the national average. This is largely due to increased demand from growth in the AI sector and, more specifically, those two markets dominating tech headcount growth among AI companies.

Overview

The incredible boom in the Artificial Intelligence (AI) space over the last twelve months has injected yet another dynamic component into the national office market—particularly in New York and San Francisco.

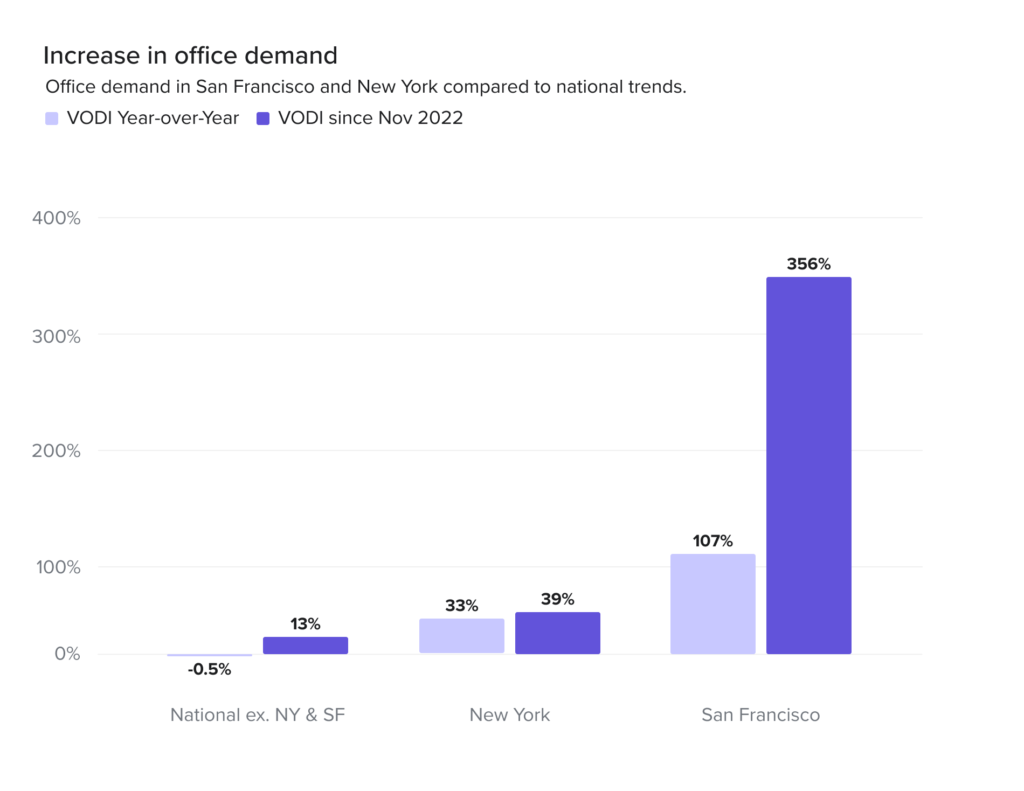

Both cities are experiencing an AI-fueled tech expansion which has pushed them to outperform national office demand levels as tracked by the VTS Office Demand Index (VODI) over the past year and since November 2022, when ChatGPT was released to the public.

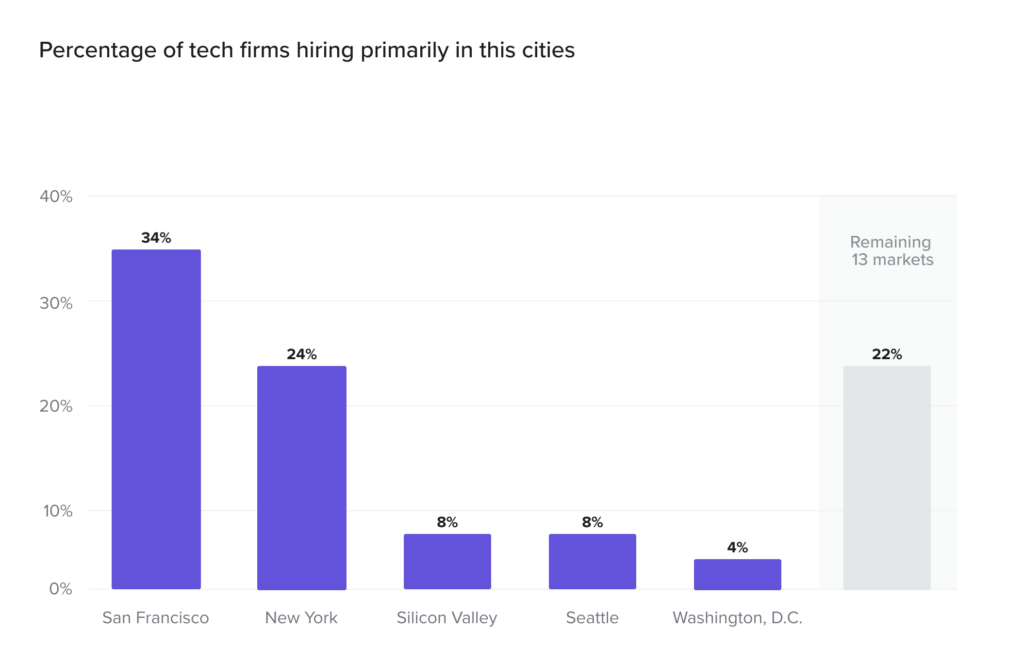

Talent Concentration: According to a report by Wing VC, which tracks top tech startups at various funding stages, these two markets alone account for 58% of the primary hiring locations as AI firms search for talent.

Tech Growth: San Francisco vs. New York

New York: Resilient Diversification

New York's tech ecosystem, as part of its large diversified industry base, has demonstrated resilient growth:

- VODI Growth: The city's VODI saw a robust 39% year-over-year increase in August 2025, outpacing the national growth of 30%.

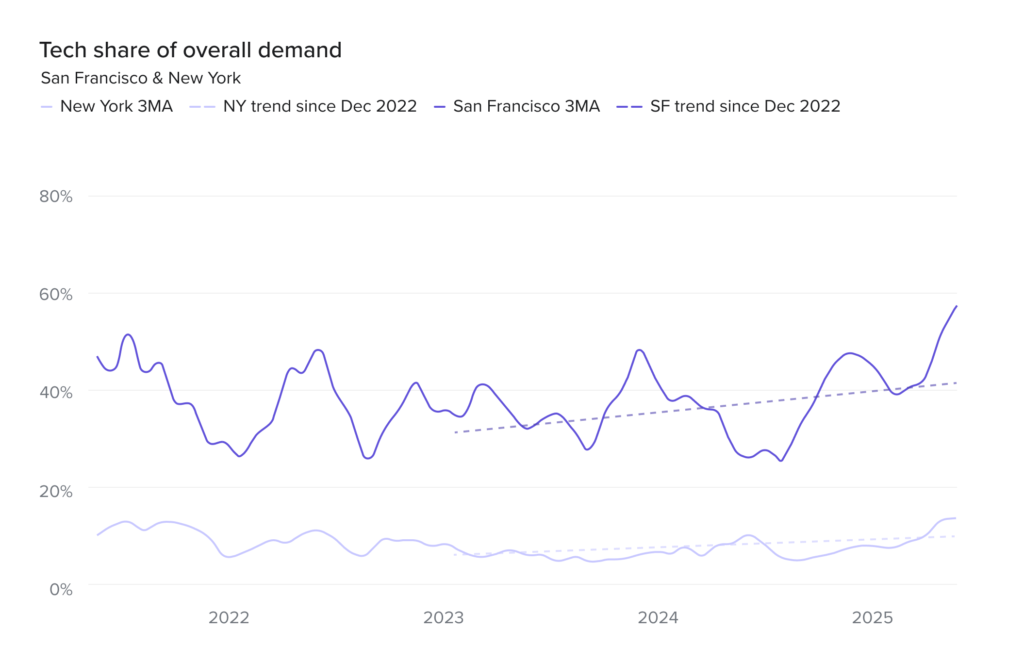

- Sector Share: Tech sector demand reached a post-Covid peak in August 2025 of 18%. This is a key indicator of the tech industry’s growing influence in a market where FIRE (Finance, Insurance, Real Estate) and Professional Services traditionally dominate.

San Francisco: The Tech Epicenter

San Francisco’s office market, heavily influenced by its dense concentration of tech giants and AI startups, presents an even stronger picture:

Record-Breaking Demand: Similar to "The Big Apple," San Francisco’s share of office demand from the Tech sector reached a post-Covid record in August 2025 of 59%—surpassing even the levels seen during the immediate tech boom at the onset of the pandemic in 2020.

VODI Surges: The city's VODI was up 107% year-over-year in August 2025 and has skyrocketed 356% since ChatGPT’s release in late-2022.

Conclusion

The surge in AI is reshaping the office landscape, with New York and San Francisco firmly positioned as the epicenters of this transformation. While New York showcases resilient growth within its diverse industry base, San Francisco presents an even more dramatic, tech-concentrated boom.

As both markets dominate hiring for top tech startups and reach post-COVID records in office demand, their leadership is undeniable. This performance significantly outpaces the national average, solidifying New York and San Francisco as the premier hubs where the AI revolution is driving an immense appetite for commercial real estate.

Explore More Insights:

To unlock additional VTS Data insights for your business, contact our Head of Research: maximilian.saia@vts.com

For additional public VTS Data insights, visit our July 2025 VODI Report

AI for CRE is here!

From proposals in seconds to instant insights, see how AI cuts manual tasks and helps CRE teams move faster.

Learn more about VTS AI