A connected prospecting and leasing platform

Gain visibility into demand for your assets and attract the right tenants to your portfolio.

With VTS, unlock real-time insights into which tenants are viewing your spaces to identify new opportunities. Seamlessly access a unified view of your portfolio-wide relationships to retain and grow your most strategic tenants.

Take a Tour Book a Demo

Gain visibility into demand for your assets and attract the right tenants to your portfolio.

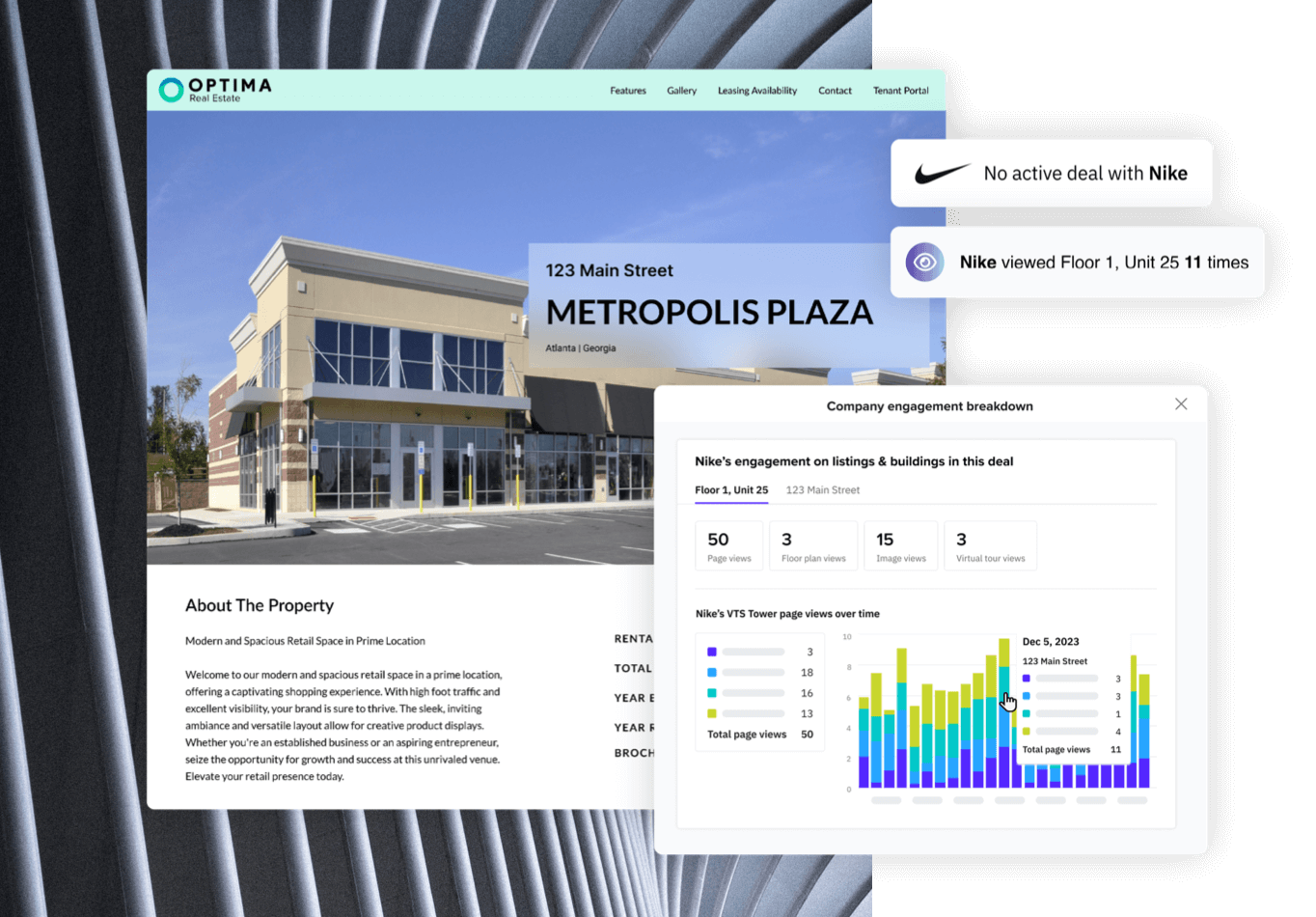

Create virtual tourbooks that target specific tenant requirements and track listing and channel performance.

Utilize one connected workflow between marketing and leasing to maintain up to date and accurate listings.

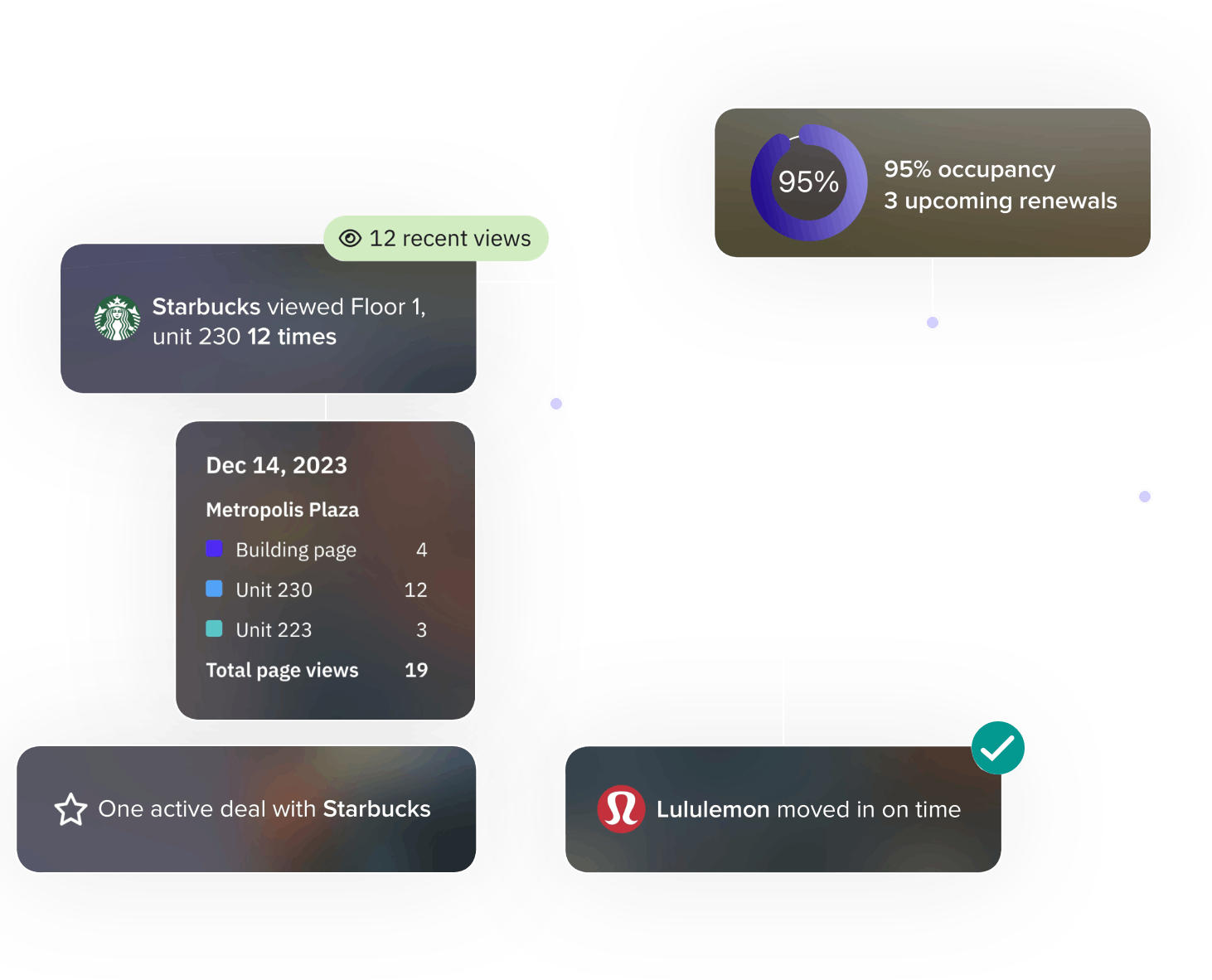

Gain a clear line of sight into tenant demand for your spaces with deanonymized views of which tenants are viewing your listings.

Be alerted if you kick a deal off with a tenant already in your portfolio to gain essential context to move the deal forward.

Ensure you're closing the best deals with centralized deal management and cash flow proposal modeling against budgets.

Leverage real-time portfolio-wide tenant insights to mitigate risk and grow your most strategic accounts.

Position your teams to move quickly form pre-lead to tenant move in with central oversight into every stage of the deal.

Eliminate roadblocks and get tenants moved in quickly with seamless and centralized project management.

The retail industry is at its strongest point in years. To capitalize on this opportunity, you need an intelligent pre-lead to lease process to attract the best tenants to your portfolio.

With VTS, seamlessly access a unified view of your portfolio-wide relationships to retain and grow your most strategic tenants. Unlock real-time insights into which tenants are interested in your spaces and unlock further growth opportunities.

VTS Retail is built to power your pre-lead to lease strategy and unlock

powerful tenant insights across your portfolio.

Lorem ipsum filler text secondary line for more description

We’ll be in touch with you shortly.

In the meantime, take a peek at our customer stories.