Q3 | 2022

VTS Green Shoots Report

Office sector pricing discovery prevails, proposal volumes jump 11.7%

VTS Green Shoots Report

Click through the map below to see which markets are trending upward (or downward) and how they stack against each other.

Discover recent trends around tenant demand and VODI data, quarter over quarter. Click through the map below to see which markets are trending upward (or downward) and how they stack against each other.

VTS Green Shoots Report

Key trends over Q3

Small tenants prove to be more resilient with large tenants declining 20% across the top 8 markets

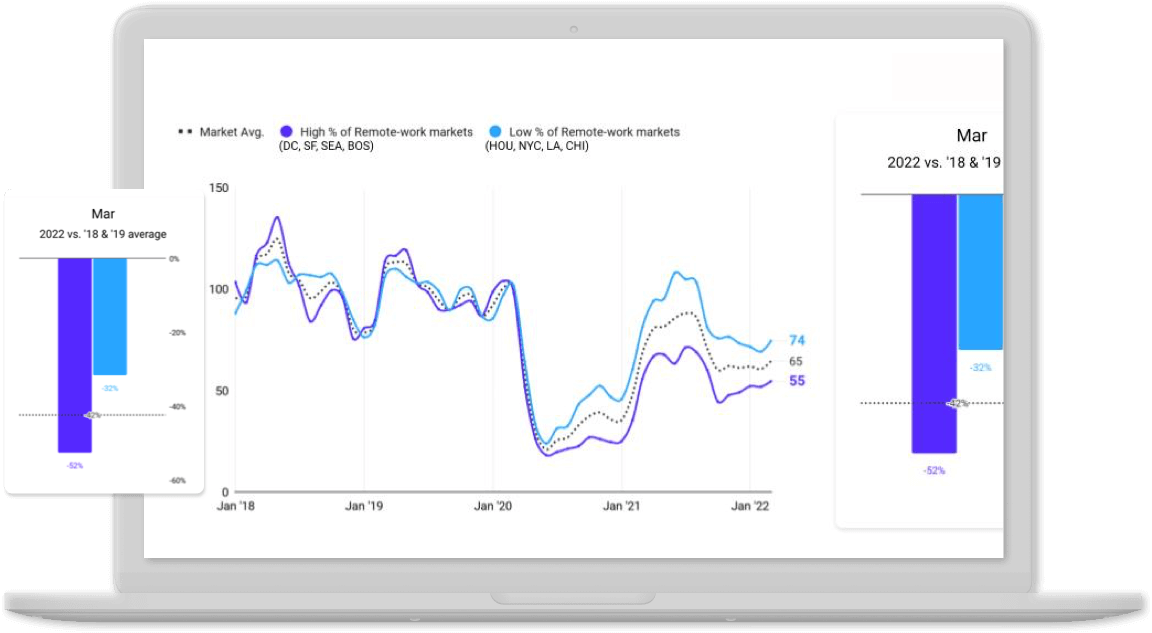

The count of large tenant (50k +sf) requirements declined 20% across the top 8 markets for the T3M over the prior period and is down 58% vs. pre-Covid levels. The count of smaller tenants (<10 sf) has remained relatively liquid, down 7% for the T3M vs the prior period and down 32% since pre-Covid.

New industries are making headlines, notably in legal, government and healthcare

Corporate RTO plans have not been as swift or aggressive as many anticipated as the pandemic focus fades. In Q3 ‘22, we have seen an uptick in new demand activity from professional services, particularly Legal in Chicago and Seattle, Government and Non-Professional Associations in NY and DC, and Healthcare across the board.

Flight to Quality (FtoQ) remains consistent and strong in 6 of the top 8 markets

Executed leases and active proposals (Class A&B) for the top 10% of rents in ‘21-’22 YTD compared to pre-Covid levels are up 1.2%, whereas the bottom 10% of rents are down 6.3%. As of Q3 ‘22, there is an average premium of 56% across the top 8 markets.

Starting rents and NERs see a decline versus the prior T6M last quarter

Based on nearly 6k lease proposals in Trophy & Class A assets (1k+ sf and 36 mo+ terms) across 8 markets over the trailing 6 months (T6M), starting rents (-1.7%) and NERs (-2.2%) both declined slightly vs the prior T6M ending Q1 ‘22. The average lease term tracked over the T6M was 7.8 years, a slight increase (+0.45%) over the prior T6M.

Access the latest CRE market trends with VTS Data

Gain your competitive edge with the numbers that matter.