FOR INDUSTRIAL

Build a growth-oriented portfolio strategy and empower your team to scale with it

Increase portfolio value by unlocking key insights that enable your team to more proactively fill leases, achieve the best deal terms, and build sustainable relationships with high value tenants

OVERVIEW

Intuitive software built for industrial landlords

Real-time portfolio data to inform strategy

Automatic alerts to seize new opportunities & mitigate risk

Unique tenant insights to accelerate deals & retain tenants longer

One centralized platform to collaborate effectively as your team scales

VTS helps industrial landlords navigate a growing sector

The industrial sector has changed forever with the growth of e-commerce and these trends have only accelerated in today's market. In order to take full advantage of the hot industrial market, landlords will need to better track demand and understand their competitors in order to capitalize on the best deals for their investment. VTS sets up industrial landlords to succeed in this growing sector.

SOLUTIONS

Tools and insights to capture accelerated tenant demand and build a winning strategy

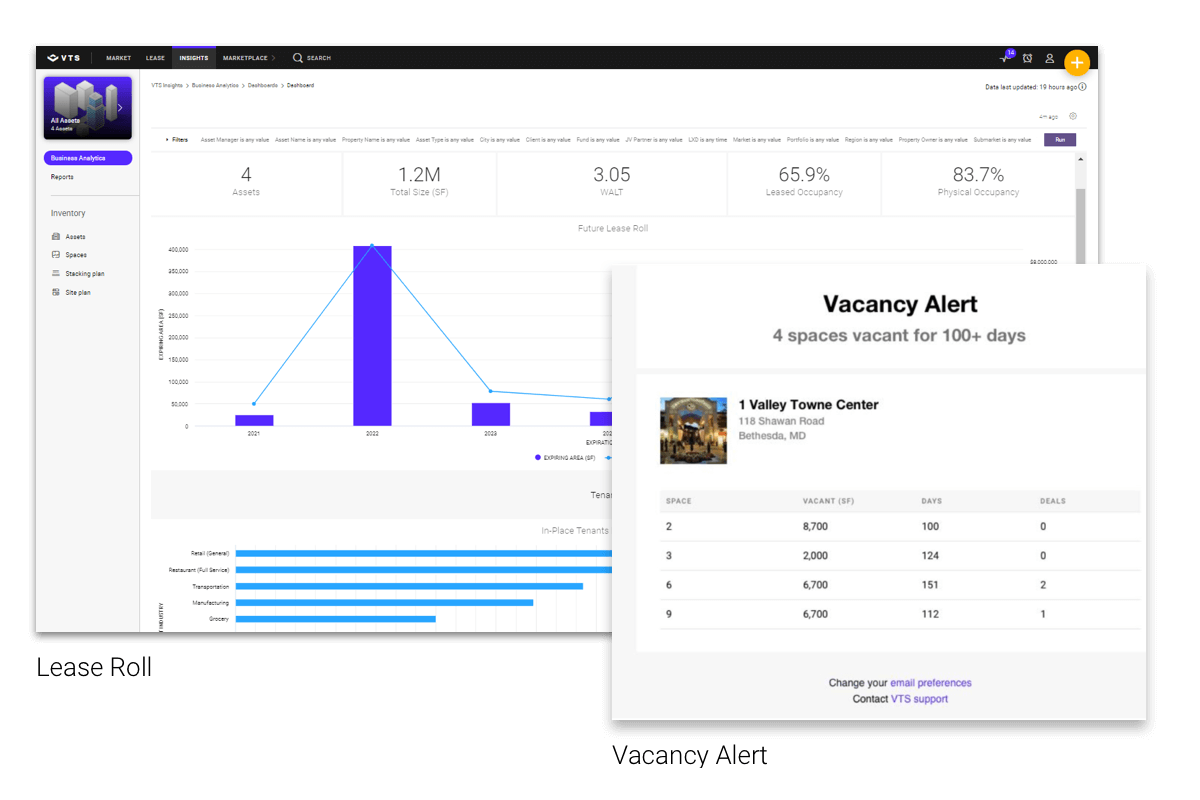

Real-time portfolio data

Be prepared to seize new opportunities with deeper portfolio insights

- Quickly visualize how your portfolio is performing across different markets to inform your strategy

- Drill into data to understand which buildings and expiring leases are the highest revenue risk or opportunity and strategize around them

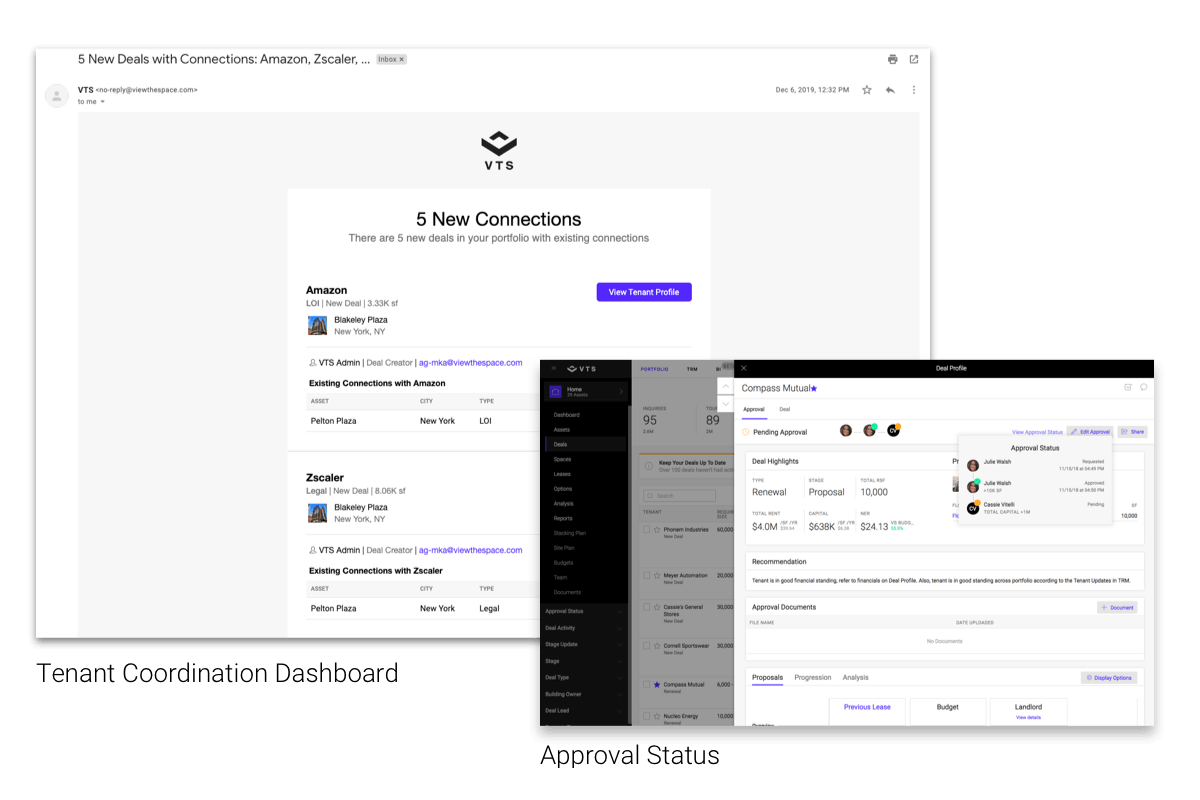

Your network on VTS

Leverage your scale to close deals faster

- Accelerate deals with alerts that uncover existing tenant relationships on new deals

- Bring your process, teams, and strategy online on VTS to convert leads to leases more strategically and efficiently

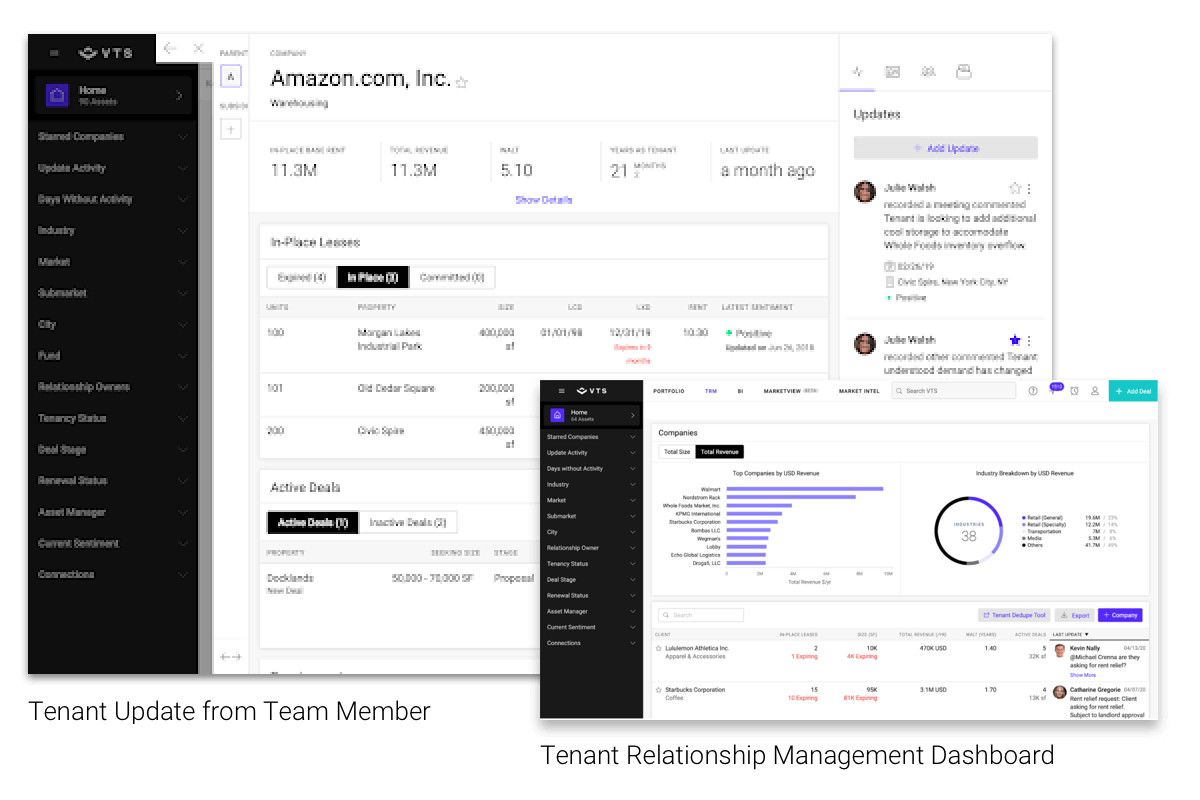

Tenant Relationship Management

Build strong, sustainable relationships with the best tenants

- Quickly see the entire history of long standing tenant relationships: leases, deals, insights from your third-party property managers and more

- Leverage relationships & historic data to convert renewal deals to executed leases

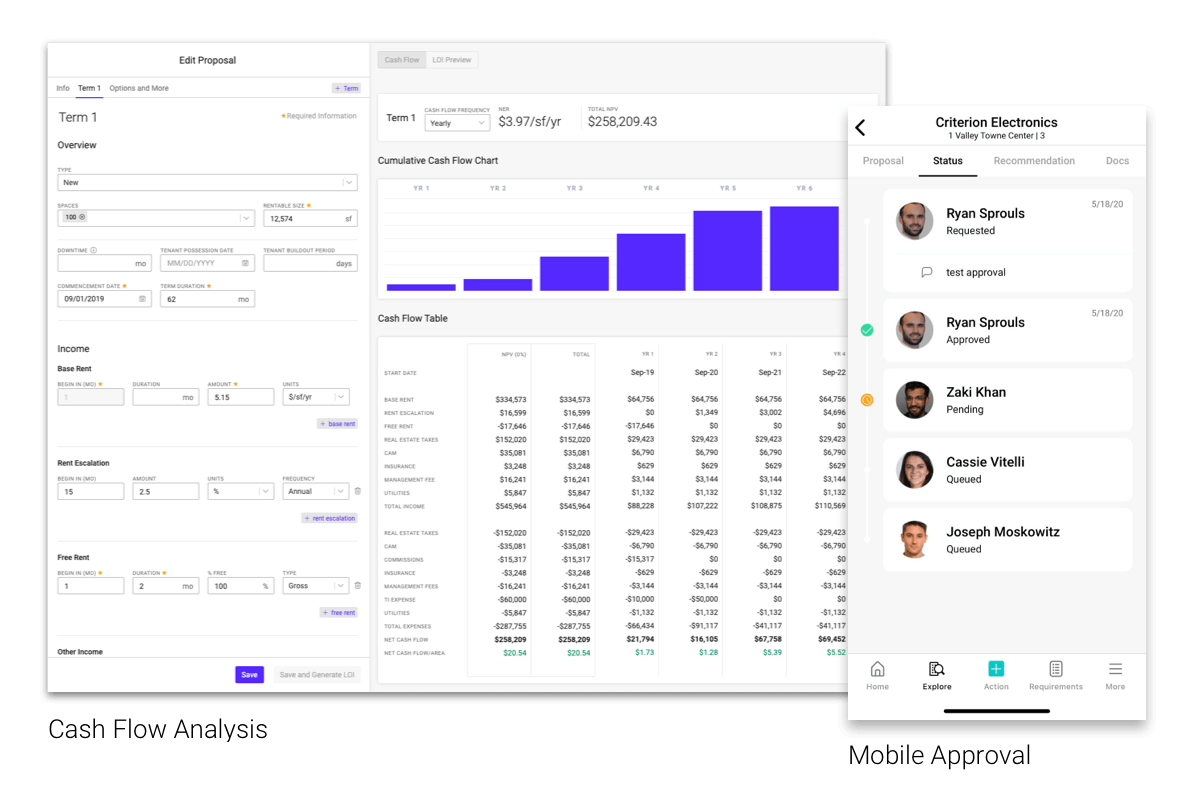

One centralized platform for your entire team

Move from lead to lease faster

- Easily manage leasing activity with 3rd party brokers and JV partners

- Compare financials to budget and previous lease to ensure you are optimizing revenue

- Track milestones and easily update projects from the field in the VTS Mobile app

WHAT CUSTOMERS ARE SAYING

Hear from customers like you

RESOURCES

Get and stay informed

MORE RESOURCES

Blog

Discover the latest trends impacting the CRE industry. Learn what you need to know to stay ahead of the competition.

Case Studies

VTS is transforming the way commercial landlords and brokers drive portfolio performance. Trusted by over 45,000 CRE industry leaders, learn how VTS can help you.

Webinars

Watch the biggest names in the CRE tackle the most pressing issues in the industry today.