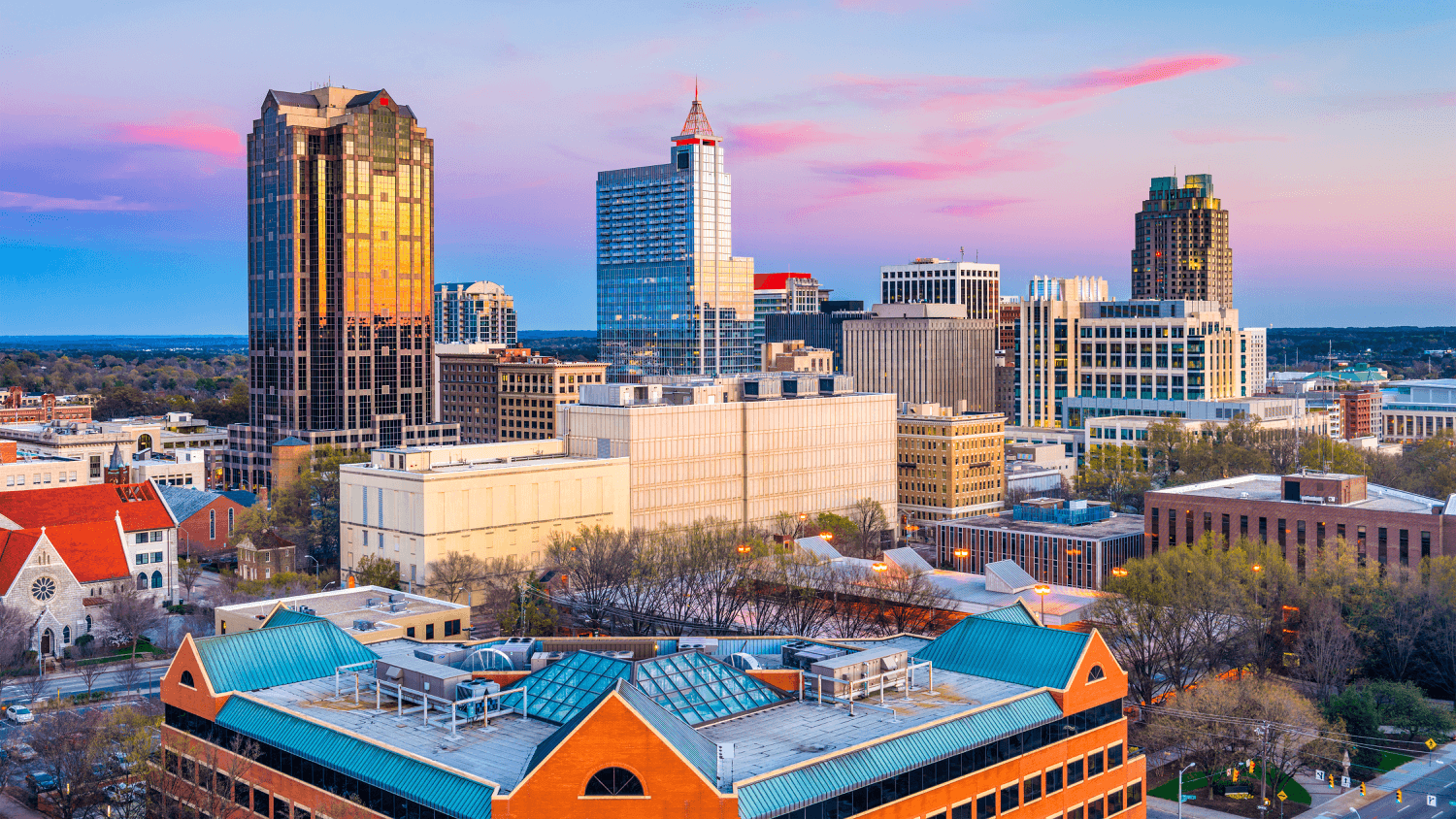

In the Triangle region of North Carolina, the Raleigh-Durham metropolitan area is again at the top of commercial real estate investors’ minds. It took third place overall in the PwC-Urban Land Institute’s Emerging Trends in Real Estate survey in the “markets to watch” section for 2019. That’s a one-spot jump from last year’s fourth place.

The strong showing is indicative of employers flocking to the area, which has a strong, educated, and young workforce that’s drawn to its low cost of living. It’s also an established technology hub in the South with the nearby Triangle Research Park, and the headquarters of Red Fin, and other firms based in (or with major operations) the Raleigh-Durham area. This has helped to draw in other industries as well.

The combination of these factors has made the metro area an extremely strong office market and has propelled the retail and industrial sectors of Raleigh-Durham commercial real estate market.

Raleigh-Durham office vacancy down, rents up

The metro area office market came in third on the PwC-ULI survey with 51% of respondents saying it’s a buyer’s arena and 36% encouraging a hold on properties.

According to an Avison Young report, Q3 office vacancies were at 12.3% in the overall Raleigh-Durham market, which is down 30 basis points from the same period in 2017. Class A vacancy came in at a tight 9.1%, falling 80 basis points in the last 12 months. In West Raleigh, 751 Corporate Center Drive came online and was delivered at 88% leased.

Among the biggest Q3 leases was:

- Insurance firm Arch Capital Services taking up 104,000 square feet in the Dillon complex of Downtown Raleigh.

- WeWork also signed two leases, one each in Downtown Raleigh and Downtown Durham.

There’s also 2.6 million square feet of office under construction in the area and 62% of it’s already pre-leased. About 1.2 million square feet should be completed by the end of the year and two projects are scheduled to break ground: the 344,500-square-foot North Hills Tower IV and the 209,145-square-foot Wade V.

Meanwhile, rental rates are on the rise. They came in at $27.91 per square foot — a record high — by the end of Q3, up 5% year over year. A lot of this increase is reportedly related to robust office transactions, which have already surpassed last year’s total by 52% as sellers usually bump rents before taking assets to market and new buyers hike them up again.

Raleigh retail follows job growth

In fifth place, the retail sector was nearly as strong on the survey, with 34% of respondents saying to buy and 45% suggesting they hold on to them.

Raleigh-Durham vacancy rates show this strategy has worked out as they’re expected to come in at 3.5% for the full year, according to a Marcus & Millichap report, down 20 basis points from all of 2017. Rents are projected to close out 2018 at $18.25 per square foot, up 4.4% year over year. At the close of 2018’s first half, they were at $17.63.

Marcus and Millichap’s report said that rising incomes and very low unemployment are driving the area’s very strong retail market. It should remain that way as construction is tempered in the area with only 512,000 square feet of retail completed between the first halves of 2017 and 2018. This was down from 890,000 square feet during the prior 12 months.

Large industrial developments on the horizon

Raleigh-Durham’s industrial market didn’t crack the PwC list for hot markets in that asset class, but the area is seeing a lot of activity in this sector.

A Colliers International report on the metro area industrial market in Q3 mentions several development projects in the works. Amazon and its 2.6-million-square-foot distribution center in southern Wake County are the biggest. There’s also the 160,000-square-foot Oakwood Business Center, among others, in the works. Meanwhile, according to Colliers, warehouse vacancy in Raleigh-Durham is very low, at just under 3.2%, while flex space is just below nine percent and dropping.

With the positive economic activity happening in the area currently, there’s no reason to think those vacancy rates won’t continue to stay competitive.